Managing Crypto Gaming Economies

Open economies, local currencies and problems with the dual token model

We often hear crypto games refer to themselves as nations. Usually, they do so to signify the feeling of community and people coming together behind a narrative. Little attention seems to be paid to the economic aspects of a nation. Things like currencies, fiscal and monetary policies, population growth, etc.

From an economic perspective, web3 and web2 games are very much different. And we are not talking about monetisation models here. Web2 games are either completely closed or, at best, semi-open. They are centrally controlled and not particularly financialised (a few things might be sold, not everything is an NFT, there’s no global market, no DEX, etc). Balancing a closed economy, while challenging, is nothing compared to balancing an open economy, which is what web3 game economies are. With NFTs and tokens, they are entirely financialised and open.

To understand how hard balancing an open economy is, think about instances of currency devaluation, hyperinflation and economic collapses in the real world. Over the decades, we have developed economic tools, like interest rates or fiscal policy, to help us balance economic cycles. In crypto games, however, economic management tools are absent.

With that, let’s talk about a few important ideas that web3 studios might want to think about.

Utility Token as a Currency

Throughout this research piece, we will focus on dual token economies. They have a governance token (AXS) and a utility token (SLP, for example).

In this framework, the governance token in the dual token economy provides either 1) claim on the resources of the “government” aka Treasury or 2) governance rights over the “government” policy. It can provide both or neither as well, and in the case of the latter the governance token is purely speculative. Overall though, unless designed, a governance token doesn’t feed into the economy in any meaningful way.

Most real world economies have their currency. So we would argue that games with a dual token model should look at their utility token as the currency of their economy. And studios should analyse that currency from an economic perspective. For the purposes of this article, utility token = soft currency = local FX.

For example, what’s the money supply growth in the economy? Printing of SLP and other game FX tokens, just like printing of new fiat money, devalues the existing money. In traditional economies, things are a bit more complex. Local currencies are spent on consumption or to pay taxes, there’s trade which can create demand for a currency and there are things like savings, mortgages and interest rates. However, in web3 gaming economies of today, there are very few ways, if any, to spend the in-game currency. There’s no trade, limited consumption (all discretionary and non-essential) and certainly no savings appeal. And even if there are ways to spend, they are driven by expected ROI and therefore eventually lead to the creation of even more tokens.

Just like in emerging market (EM) economies, if your currency collapses, your economy will follow. In EM, currency devaluation against USD usually occurs due to political or economic shocks, leading to the loss of confidence in the local economy and currency. This results in a bank run, with locals rushing to sell local FX for USD, causing further currency depreciation. Eventually, the central banks step in. Their playbook features monetary policy tools (hiking or cutting rates), capital controls and currency intervention. You can obviously combine these measures in some way. For example, hiking interest rates while imposing some capital controls. This eventually leads to stabilisation of the FX, often temporarily.

Crypto gaming economies are even more reflexive with much fewer tools currently. With that reflexivity, once the community loses confidence, it’s game over.

More recently, we have seen some examples of capital controls and currency intervention in crypto games. DG is looking to impose capital controls, for example, and they are already intervening in the market using proceeds from primary sales, validator node rewards and even revenue from a recent advertising deal to buy and burn ICE.

Heroes of Mavia imposes a penalty for withdrawal from the ecosystem. We have also seen the development of OTC / grey markets to avoid capital control measures like staking with lockups.

Open Economies and Global Macro

One of the downsides of open economies is their reliance on external factors. We learnt this with globalisation and the great interconnectedness of local economies in the worldwide economic web. While EM economies might be affected by politics, commodity supply shocks or policies of other countries, crypto gaming economies are mostly affected by the external crypto and therefore broader macro environment as it pertains to capital flows. When the global macro is deteriorating, people flee from EM FX to USD, for example. In crypto, people flee from their game economy currency into USD or their local currency. It would be my guess that in challenging economic conditions, the percentage of net SLP minted that gets sold right away is significantly higher than when things are good.

The reason this is important is that crypto gaming economies will invariably go through economic recessions due to global macro conditions. What they should try to do though, is not go through recessions due to policy errors of “governments” aka studios, in times of favourable economic conditions. For this, studios could study the economic lessons of EM economies and lean into some of the existing economic models.

Dealing with FX Depreciation in Crypto Gaming Economies

We are still extremely early in researching this topic.

However, in the absence of any external demand (exports) and essential internal consumption, it seems rather safe to assume that the majority of games’ local currencies entering circulation will be sold. This is likely to happen in all market conditions, given the “earn” nature of crypto games and their open economies.

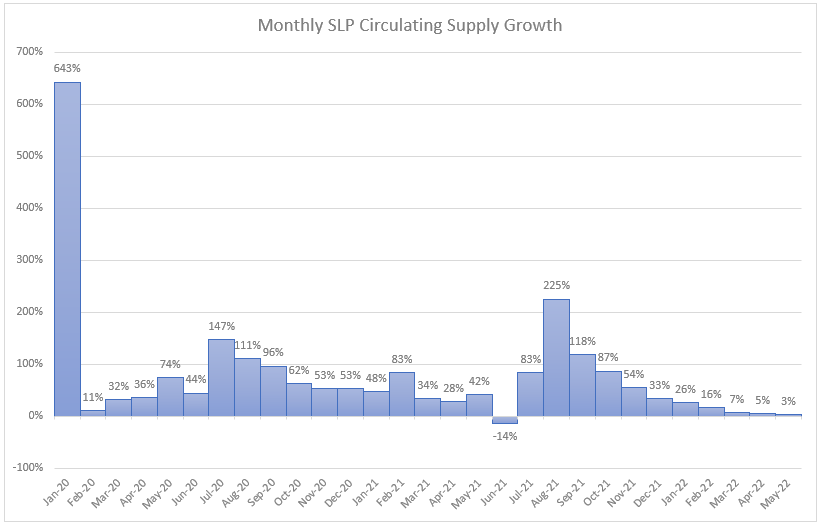

Therefore, the monthly rate of expansion of money supply aka growth in circulating supply should be indicative of the selling pressure and, in our view, is a key metric that studios should focus on. This is different from the burn to mint ratio. While the burn to mint ratio can be 0.8, that 20% that is not burnt could represent any rate of growth in the circulating supply resulting in different levels of selling pressure.

There are different loops and mechanisms that can help with restricting money supply growth. Broadly, they fall into two categories, 1) limiting the supply growth and 2) increasing demand for the local currency. Here are some examples:

Limiting supply growth

Flat out reduce the level of incentives being paid out.

Design breeding loop to be deflationary.

Say 3 lower level NFTs can be combined into a higher level NFT. Burn the 3 lower NFTs and have a higher-level item generate less in terms of earnings for the player but make up for it in other perks / status.

If not possible, target a certain inflation rate for the breeding process.

Population control is directly connected to money supply in crypto games. Population control measures, including breeding seasons or deflationary breeding loops are part of this.

Capping the lifetime earning potential per NFT, with a factor of less than 1 applied to earnings over time.

Increasing demand

Mechanisms / incentives for internal spend of capital. Although if you advertise play-to-earn, the players are more likely to look to cash out. It’s not “earn” unless you can convert to your local fiat. These also have to be non-inflationary down the line.

Use time as a dimension of the game. While capping the lifetime earning potential of NFTs is limiting supply growth, allowing players to repair items to extend their life could be a mechanism to increase demand.

Design a game in a way that soft currency can’t be taken out, but needs to be used in game (crafting, progression) and the results of that use can be converted to fiat via marketplace. This might kill the two token implementation, but such a game will likely have other tokens for materials, items, etc. Added benefit is that this activity can be taxed, while players selling your soft currency often can’t be, unless a studio controls the exchange infrastructure a la Katana, but even then there’s a direct on-off ramp from Ronin to Binance for SLP.

Should Gaming Economies Ease Policy into Recessions?

In EM economies, a recession always leads to loose monetary policy and greater fiscal spending. However, these measures are somewhat irrelevant as EM economies are mostly dependent on the global cycle. For example, a rising dollar tends to trigger all kinds of economic havoc in EM counties. So should crypto gaming economies follow the same pattern - increase spending and incentives at the times of economic stress and reduce spending when things are good? While counterintuitive, we think that gaming economies might be better off going the other way, at least in the beginning. They have no external trade of any kind and no essential domestic consumption that is not based on financial return. Therefore, in-game FX has nowhere to go but into fiat and “easing monetary or fiscal policy” is unlikely to have any impact. Instead, teams might consider reducing spending and incentives during recessions, waiting for the macro cycle to turn around and then turning up the money printer, when they know that there’s likely to be enough capital to absorb the new issuance.

Looking at Axie, for example, the team was able to significantly bootstrap the Treasury throughout 2021 and early 2022. If they chose to follow conventional policy, they could turn on the taps now, providing incentives and increasing spending across the ecosystem. This would have to come from ETH in the Treasury, not SLP, and be done in a way that doesn’t further devalue the SLP. We could even explore debt funding of these initiatives, backed by value accrual to the Treasury. However, it’s possible for Axie to do this because the Treasury has been able to grow during the good market and economic conditions. Essentially, Axie’s national balance sheet is rather strong.

For teams that haven’t bootstrapped the Treasury during good economic times, there are very few options. Spending capital from raises on trying to reinforce the FX is pretty much hopeless in this environment. Instead, teams can focus on developing products, finding and rewarding true ecosystem contributors and nurturing the community through various targeted programs and incentives.

Is the Dual Token Model Broken?

From an economic perspective, the dual token model seems to make little sense. Further, there’s an underlying conflict between the governance token and the soft currency.

Games using the dual token model grant rights to the financial success of a game and control over policy and resources to the governance token. Yet, players who make a game financially successful (as tax on economic activity is the predominant monetization model in crypto games) have no rights and own the highly inflationary local currency. This construct is actually value extractive both ways. Governance token holders extract value from players and their economic activity. Yet, players extract value by farming and dumping the local currency. Ain’t nothing (3,3) about it.

In this construct, the local FX will always get sold. Clever economic design can limit the growth rate of money supply, which can be absorbed by new players coming in, and be sustainable for a while. But new players mean more money supply, more selling pressure and more value extraction. Teams will have to come up with yet another sink every time and it’ll look very much like a dog chasing its tail.

An alternative is to deploy revenues generated from economic activity into balancing the local FX. This is perhaps the only incentive lever that does not inflate the local currency. An example would be creating an equivalent to a local interest rate by directing a share of revenues towards the local FX stakers. However, this takes money away from the governance token and it’s hard to see how governance token holders will vote for that over any meaningfully long time frame.

We are seeing two interesting examples of this play out right now. Axie, for instance, is paying staking yield to AXS holders and is also going to be paying staking yield to land holders. At the same time, its player base is getting decimated. So they are choosing to reward capital and token holders, at the expense of the players. Decentral Games, on the other hand, are using assets in the treasury in an attempt to balance the ecosystem. For example, they have used validator node rewards to buy and burn ICE and are now using revenue from secondary sales and the ad deal with Mastercard to do the same.

There’s another limitation of the two token model that might lead to the same conflict between the governance token holders and the soft currency users. As local FX, these soft currencies require deep liquidity, especially given the fundamental selling pressure of the two token economic model. Where will this liquidity come from? A simple answer is that it either has to come from the team (premint or buying with treasury funds) or from the users. However, we know that users need incentives to LP and incentives are always inflationary, unless paid out of the revenue which, again, pits governance token holders against the players.

A Call to Action

At MetaPortal DAO, our mission is to assist crypto games in designing sustainable economies that accrue value.

If you are a crypto gaming studio or project and want to talk to us about your in-game economy, we’d love to hear from you.