MetaPortal Research - All-in on Decentral Games

Introduction

Decentral Games (DG) is the first community-owned and DAO-governed casino ecosystem. By designing a series of venues where players can socialise and enjoy live music and games, they have created a highly engaging environment allowing them to tap into demand from outside of just the gameplay crowd.

Their tagline is 'Be The House,' alluding to the fact that $DG holders can govern the value captured by the games taking place in the casinos. This is a powerful message and one that we see repeated across the crypto space. Protocols use blockchain technology to flip the existing power structure in various industries by decentralising ownership and sharing the upside through tokenomic alignment of incentives. DG have designed their ecosystem cleverly to do just that, aligning players, token holders, liquidity providers, and governors alike.

It's not just tokenomic design where the team is thinking ahead. They use Polygon's scaling solution to deliver signature-less and free in-game transactions and have done so since launch. With Ethereum finally scaling through sidechains and rollups and teams scrambling for a strategy, DG are ahead of the pack, calmly staking on a Matic node, the validator rewards from which add to their treasury total. Best of all, the end-user can benefit from fast and free transactions without needing to understand the tech behind them.

To date, Decentral Games have made Decentraland their home, choosing not to venture into any other blockchain-based virtual worlds. However, this hasn't prevented their growth. They have built up a treasury worth nearly $10m and saw their latest venue launch breaking records for most concurrent players in DCL at 1,421. On average, they see between 500-1000 unique visits per day, with 100 DAUs using crypto to interact with games.

What trend are they trying to capture?

DG sits at the intersection of three exciting trends - virtual worlds, gaming, and blockchain technology. Here, they can capture the human propensity to gamble and combine it with the opportunities afforded by Decentralised Finance (DeFi), all inside a virtual environment. Interestingly, this makes the $DG token the epitome of a Metaverse Index inclusion. The index aims to capture the trend of business, entertainment, and social interactions moving to take place in virtual environments.

Starting with Chateau Satoshi and Serenity Island as their first two venues, the team has since expanded to Tominoya and more recently the Atari casino to host their games. Games are not the only thing on offer at the venues, as DG regularly host events, including NFT auctions and live music, as well as their community meetings. They haven't stopped there either. In April, it was announced that the world-famous Ibiza nightclub Amnesia is coming to Decentraland in partnership with DG.

This is important because it starts to really expand the scope of what DG can offer beyond casinos. They will have a virtual nightclub that can host live events, act as a stage for new artists and pave the way for merchandise and collectibles. By developing critical partnerships like this, Decentral Games can diversify their community and the experiences they can offer within DCL. Crossovers can also bring new users into the crypto space. We believe this will be a significant gateway to growth in the future and vital to sustaining these virtual businesses.

Interestingly, the DG roadmap mentions adding a Virtual Reality (VR) client in 2022 to become the first 'VR Metaverse casino experience.' VR is a trend that is still struggling to gain traction. Despite calls for years that predicted 8 figure sales by 2020, last year saw just 6.4m units sold. With Google Glass firmly in the rearview mirror, attempts at integrating augmented or virtual reality are coming back into fashion. Snapchat is reviving AR glasses, Facebook is devoting numerous resources to VR tech, and many headsets are already available on the market. With so much energy focused on making it work, the inflection point for 'hockey stick' growth in VR adoption looks closer than ever. Based on the evidence, 2022 seems a realistic timeframe for DG to come on-stream with a VR solution, opening the way to most people's vision of what the Metaverse will look like. Somnium Space is currently the only virtual world offering VR compatibility, seeing around 1500 DAUs in Somnium WEB client and 100+ DAUs in VR / PC clients. However, whether this path opens up another avenue to onboard new users to the DG ecosystem remains to be seen.

Let’s talk more about the tokenomics

Given the ecosystem is 'powered by $DG,' the token plays a pivotal role in how Decentral Games runs. With well-designed tokenomics, the DG community can incentivise positive protocol actions. Examples include:

Enabling liquidity for the $DG token.

Ensuring active governance participation.

Generating revenue through exciting and accessible gameplay.

As illustrated by the flow diagram above, the token is used to reward helpful participation in the ecosystem. For example, players earn $DG rewards for playing games, LPs earn $DG for providing liquidity, and holders earn $DG for participating in the governance of the casino funds treasury. Let's dive a little deeper into those incentives:

Gameplay rewards incentivise players with $DG for playing games with $MANA or $DAI among others. DG use a unique 'play-to-mine' rewards model based on several factors. For example, higher $DG gameplay rewards are given to users playing together at the same table. This dynamic is designed to incentivize a lively virtual casino with a social atmosphere. Other factors that influence rewards are:

Blackjack/Roulette play-to-mine function - an equation determining $DG mined per MANA or DAI wagered in blackjack/roulette.

Affiliate rate - a bonus rate for all wagers placed through addresses a player refers.

Multiplayer bonus - play-to-mine rate multiplier all players enjoy when playing with 2, 3, and 4 players at the same table.

NFT wearable bonus - play-to-mine bonus for players wearing a decentral.games NFT wearable while playing games.

Liquidity incentives have been consolidated to a single Uniswap V2 ETH/DG pool. As compensation for opportunity cost and impermanent loss, liquidity providers to this pool are rewarded with $DG tokens, currently at 83% APR. There are also wETH-$DG pools on QuickSwap and SushiSwap that earn APY in $QUICK and $SUSHI, respectively.

Finally, governance rewards exist to encourage a diverse group from the community to put forward proposals and participate in discussions around the direction of the DG ecosystem. Rewards are distributed for staking $DG, and there's a bonus for submitting and/or voting on proposals. Today, holders can stake $DG and earn 38% APY.

It should be pretty apparent by now that there's plenty of whitespace with token economics when it comes to incentivising positive actions. DG are certainly taking full advantage of that, even going so far as to curate the venue atmosphere with cryptoeconomics.

Treasury and value capture

So right now, the $DG token is governing value rather than directly capturing it, as income from gameplay is accruing solely to the treasury. At the same time, active participants in the ecosystem can grow their share of tokens through the behaviours described above.

Now for some hard numbers. The gameplay treasury grew from $65k at the start of 2021 to $2.2m at the time of writing. That's an average of $427,000/month or $5.1m in annualised earnings from gameplay alone. For clarity, the gameplay treasury refers to where player fees are collected and can act as a float from which winnings are paid out.

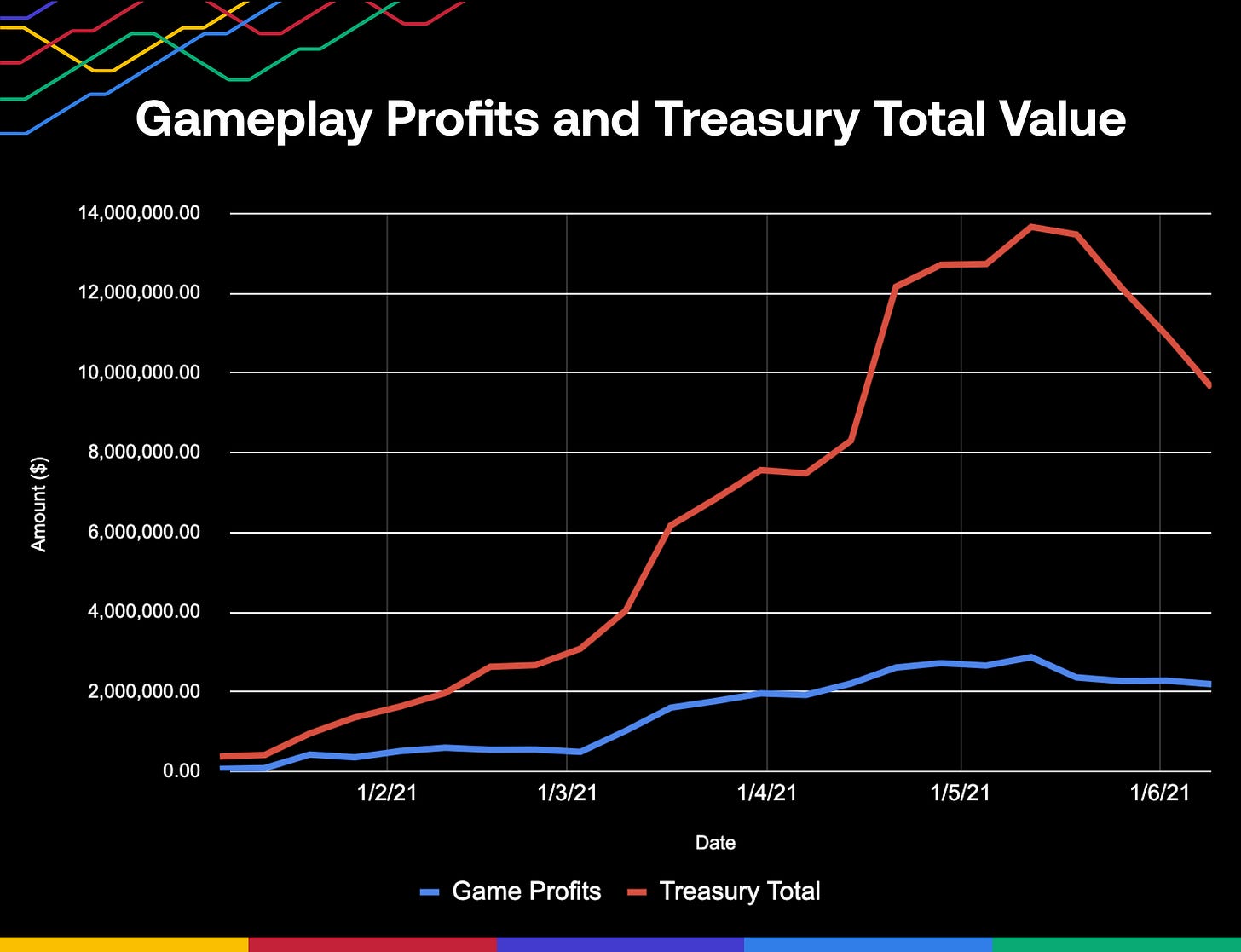

Over time as value accrues in the gameplay treasury, $DG holders can decide how to allocate that capital. So the total value of DG’s holdings grow, while gameplay profits are periodically divested into liquidity positions, yield farms, etc to become productive. The chart below shows this process, with game profits staying fairly flat but the total treasury value rising steeply. It's worth noting that this is as much an outcome of organic income as the price of the tokens held in the treasury. This inevitably leads to some volatility, as reflected in the data.

Beyond just games, there are two other significant sources of income for DG, with the largest being rewards for staking on a Matic node. At approximately 15% APR, this brings in roughly $260k per annum based on the $1.7m currently staked. These rewards are presently being reinvested into the staking contract, compounding returns.

The second source of revenue is from the incentives on LP positions. DG currently provide liquidity to MVI/ETH and DG/ETH, receiving $INDEX at 25% and $DG at 82% APR, respectively. This comes out to $1.14m per annum at today's prices, although the rates are highly variable depending on pool size and token price.

Taken together, and bearing in mind some of the caveats, this gives us a total of $6.5m in annualised earnings. At the time of writing, with $DG trading at $123.7, the price/sales ratio is 4.5x based on the circulating cap of $29.8m, or 19x based on the fully diluted market capitalisation of $123.7m.

Treasury Diversification

Treasury diversification is a topic worth diving into separately, given we just touched on how governing the value locked in the protocol is the primary responsibility of $DG holders. Decentral Games have gone to great lengths to ensure their treasury is productive and diverse.

As the snapshot above shows, the treasury is holding a wide range of assets. Firstly there are different token types, from ERC-20 governance and gameplay tokens to the ERC-721 non-fungible standard, the kind underlying both Wearables and Land. Beyond the difference in token standards, there is the diversification of tokens themselves. DG hold stablecoins in the form of $DAI and governance tokens like $MANA, $INDEX, and their very own $DG. The team also recently expanded the universe of accepted gameplay assets to include $USDT, $ATRI, and $ETH, which will further diversify the treasury going forward. And of course, there is $MATIC, staked to a node which, in a truly symbiotic relationship, earns rewards while securing the Polygon chain, on which DG carry out transactions. Finally, the DG DAO owns 1,007 parcels of DCL LAND, a little over 1% of the real estate in Decentraland.

LP positions further spread the risk, pairing DeFi tokens with ETH to earn trading fees and liquidity incentives on top. As we touched on above, DG are providing liquidity to the MVI/ETH pool, passing a governance proposal that sees them earning $INDEX tokens from a $125k position. As the methodologists behind MVI, we were delighted to foster a partnership in this way. From DG's perspective, MVI offers exposure to the broader metaverse thematic, diversifying portfolio exposure and the treasury in the process.

So Decentral Games have a treasury makeup that most projects could only dream of right now. This is not reflected in the numbers on the open-orgs website, where DG appear a fair way down the order in absolute terms.

And while the absolute number will continue to grow steadily based on performance to date, with only $230k or 2% in stablecoins, there is potentially room to improve the treasury's 'all-weather' ability. The burn rate will be the subject of a further deep dive into the numbers behind Decentral Games, but with all other treasury assets so highly correlated, this doesn't leave a lot of runway if market conditions turn.

The house always wins?

Overall, the impression of Decentral Games is one of an intelligent team, making the right decisions, often before the rest of the market has woken up to a particular topic. Underpinned by well-designed tokenomics, DG is able to capture economic activity in the Decentraland virtual world and steadily grow their treasury. By looking for ways to diversify beyond a purely gaming model into other social events and spaces, they can foster a more diverse community and generate new income streams for the future.

Their current operation is not without risk, however. Limiting the ecosystem to just one virtual world is hugely asymmetric. If DCL fails to gain wider adoption, the upside for DG venues might be limited. It could be the case that non-crypto natives looking to attend a virtual event aren't concerned with where it takes place. In this case, Cryptovoxels offers a much simpler user experience without the need to sign transactions using a web3 wallet. Another consideration, and one that we will monitor closely in the figures, is the potential diminishing returns of opening new gameplay venues. Without an external source for growing the user base, opening new venues will likely just spread any activity more thinly across a greater number of locations.

Having said that, increasing use cases by working with credible partners like Atari and Amnesia, plus the minimal competition in virtual entertainment venues leaves Decentral Games holding all the cards. Cryptovoxels events tend to come and go, and Sandbox is potentially 3-6 months away from being fully operational. There are no other gameplay offerings within Decentraland. Finally, the P/S ratio is compelling given the project’s fundamentals, and also relative to other valuations in the space.

They say the house always wins, and from what we've seen so far, we'd wager Decentral Games will not be an exception to that rule.