Get liquidity for your NFT now via NIFTEX

Build new communities around your NFTs/Land and unlock liquid NFT markets with NIFTEX fractionalization. Try it out here!

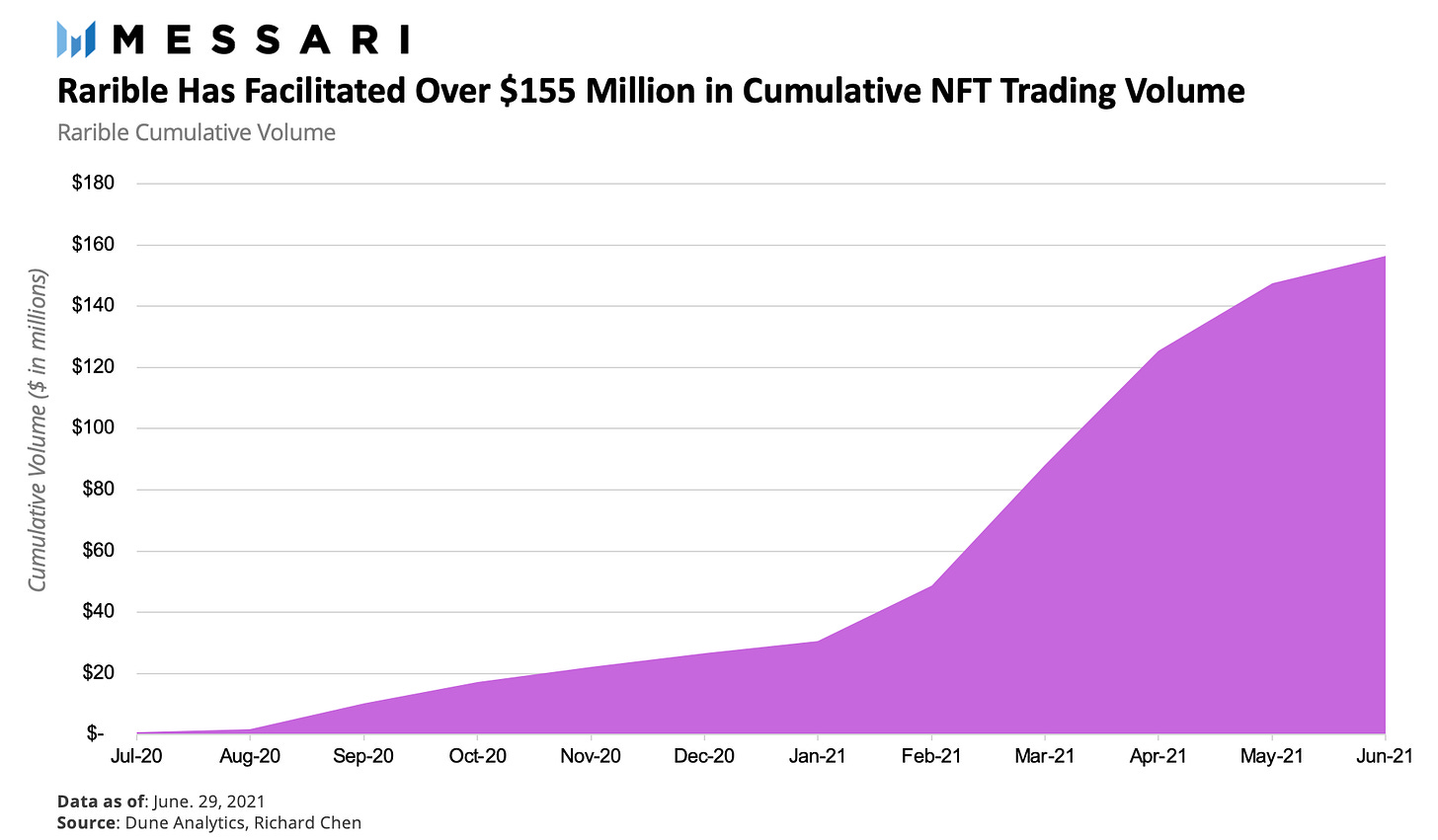

New assets often have very illiquid markets, that is to say, there isn’t a robust marketplace of buyers and sellers. However, as new assets grow in value the marketplaces that facilitate the exchange possess the opportunity to rise in value. As Bitcoin grew, Coinbase, Kraken, and other exchanges emerged to facilitate the market demand. As sneakers became more ingrained into culture, StockX and Goat spun up to serve these customers. Non-fungible tokens (NFTs) have entered a similar stage of growth, paralleled by the launch of several niche platforms and generalized marketplaces over the past few years. Initially launched in 2020, Rarible is one of the newer marketplaces, yet has experienced impressive traction in its short lifespan becoming one of the most successful NFT marketplaces with over $155 million in NFT trading volume.

Coming off of the recent NFT bull market, Rarible announced its Series A, raising $14 million to build out its NFT marketplace and further the development of its NFT protocol.

Raring to Go: The Rarible Protocol & Marketplace

Rarible aims to create a liquidity layer for the NFT ecosystem through the Rarible protocol. Rarible.com is a marketplace built atop of the Rarible protocol, which lets anyone create, buy, and sell, non-fungible tokens.

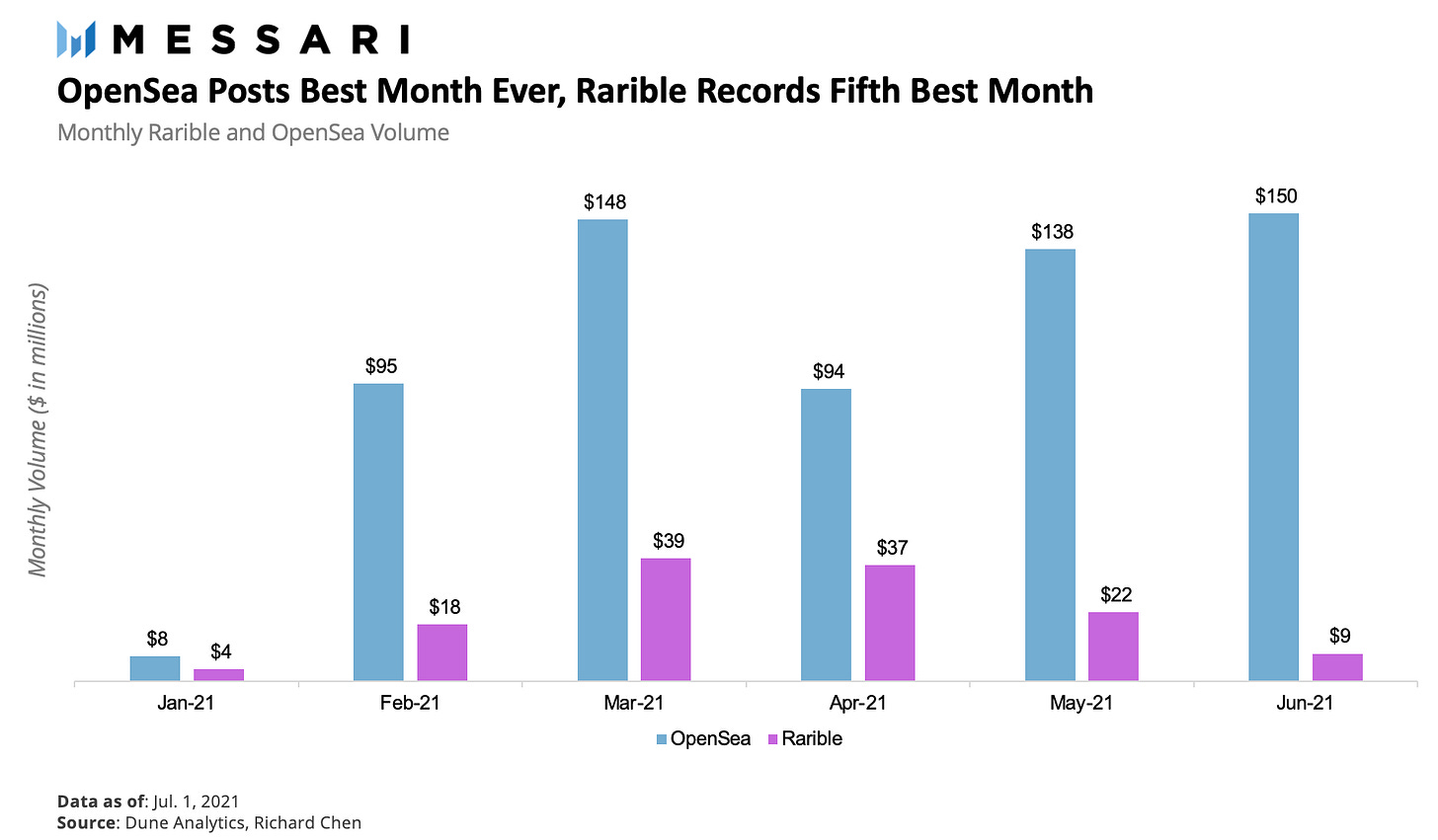

Further, Rarible experienced a sharp increase in platform users during the March NFT market high, but has since reverted to prior levels over the past few months. While the NFT market has continued to grow in specific niches like NFT avatars (Meebits, Bored Apes, etc.) Rarible was unable to capitalize on those trends and users went to platforms like OpenSea which offered users the ability to trade those new NFTs.

Similar to most marketplace, Rarible takes a 2.5% per sale on both ends of the transaction which equates to a 5% fee on all sales. To date, Rarible has generated nearly $8 million in revenue since its launch in December 2020, with $3.8 million of that revenue coming within the past 90 days.

Got a Glock in my $RARI

Rarible’s token, – $RARI – acts as a governance token for the Rarible DAO, governs the Rarible protocol, controls the remaining $RARI treasury, and accrues fees from the Rarible marketplace and protocol. $RARI token holders can create and vote on proposals that govern the Rarible protocol including fee control, platform moderation, fund feature developments, marketing expenses, and more.

Buyers and sellers on the Rarible marketplace are rewarded with $RARI with the intention that governance of the protocol should be distributed to those who most utilize it. In this vein, 10% of the RARI supply was initially distributed to NFT holders, regardless of the platform they were purchased on.

The Path Towards Decentralization

The Rarible community has continued to push towards greater decentralization, making an effort to codify a governance process.

While most DAOs operate with a 1 token: 1 vote model, Rarible is in the process of altering this existing standard. According to a recent proposal, the community is proposing a time-weighted vote, by which tokenholders would receive 1) greater voting power and 2) RARI governance rewards based on the length of time RARI tokens are locked.

Essentially, rewarding individuals for locking their tokens, provides an incentive for governance. Additionally, providing a time-weighted vote ensures that smaller stakeholders are able to exercise outsized influencer compared to larger stakeholders. Time-locked voting can also prevent stakeholders from purchasing tokens on the open market for a single vote. While the Rarible community hasn’t decided on the exact staking rewards or governance power multiple, it’s an exciting update that should serve well in aligning the Rarible community.

Rarible in a Sea of NFT Platforms

Rarible provides liquidity incentives for NFTs minted on its platform by distributing $RARI to the top buyers and sellers each month. While $RARI NFT liquidity mining initially jumpstarted the marketplace, Rarible has been unable to compete with OpenSea in recent months despite its incentives.

This is predominantly because OpenSea has been able to sustain its volume by transitioning from one NFT trend to the next (e.g. CryptoPunks to HashMasks to Meebits to Bored Apes) while Rarible did not offer non-Rarible assets on its platform. While Rarible recently updated its marketplace to integrate other smart contracts – NFT projects – Rarible lost market share to OpenSea in the interim period.

OpenSea remains the largest and most successful marketplace for NFTs, in part due to its first-mover advantage and its focus on aggregating sales of all other NFT platforms evident from the fact that Rarible ranks second in all-time volume on OpenSea while SuperRare – a leading art marketplace – ranks sixth.

Even though billions of dollars flow through NFTs, the market is still incredibly young and there’s plenty of room for expansion.

And, while Rarible’s volumes are lower than OpenSea, all is not lost, as the platform now facilitates the buying and selling of all types of NFTs, including popular projects like CryptoPunks, Sorare, and Axie Infinity. For the Rarible marketplace to continue to compete with OpenSea, it will need to continue to expand its asset breadth, usability, and other features like NFT auctions and celebrity drops.

Rarible is also the only tokenized platform of its closest peers like Zora, Mintbase, and OpenSea. Although, it’s possible that existing platforms will launch tokens of their own in the future, this remains a core advantage of Rarible as it has allowed the protocol to bootstrap its marketplace, bring on new contributors through an incentivized community, and integrate into DeFi through products like the Metaverse Index.

The key advantage of open-source protocols like Zora and Rarible is the permissionless nature that enables third parties to develop applications and create value on top of them. For example, Mirror – a decentralized blogging platform – and Catalog – a music ownership protocol – have both built on top of Zora by integrating Zora’s zNFTs (a wrapper for ERC 721).

Similarly, the Rarible NFT protocol has enabled the development of applications like SING which allows musicians to monetize original work without middlemen, control listings, and engage directly with fans. SING utilizes Rarible’s “lazy minting” which allows musicians to list NFTs for sale and only incur gas fees once the item is sold.

The Rarible Roadmap

Rarible’s recent funding announcement teased a few new features and integrations including:

Layer-2 solutions for scalability and sustainability

Credit card payments

Adoption of Flow blockchain

Multiple partnerships and drops

Most notably of the upcoming updates is the integration of the Flow blockchain which has been largely successful because of its flagship product, NBA Top Shot. As Flow starts to develop and license more content, Rarible might have the opportunity to become one of the first cross-chain NFT marketplaces thereby capturing more NFT trading volume as the market expands.

Building greater partnerships can help increase platform volume and generate new users who otherwise wouldn’t have come to Rarible. For example, Twitter launched a collection of NFTs on Rarible in a unique partnership that pairs well with crypto’s Twitter-centric ecosystem.

While partnerships and drops like these are interesting, the long term success of Rarible will be determined by its ability to become a middleware layer protocol for other types of NFT projects.

With the upcoming launch of ImmutableX and several other NFT focused Layer2s, trading volume may move up the tech stack. This has already started to play out with projects like Axie Infinity shifting onto Layer-2s and conducting a significant amount of volume in their own marketplaces. As trading volume for NFTs shifts to Layer-2s, aggregating these marketplaces will be important in order to follow customers.

Final Thoughts

In summary, Rarible’s potential advantages come down to its 1) generalized nature, 2) the protocol’s ability to integrate with other NFT projects, 3) the continued expansion of its marketplace offerings, and 4) its integration with other Layer2 and Layer1 blockchains.

Rarible sits in a unique position as being one of the only tokenized NFT marketplaces and liquidity protocols, however, that may change over the coming months if existing protocols issue tokens on their own. Still, the belief that open, permissionless systems yield better results than closed systems is one that the majority of investors in the crypto community hold. And, as the NFT market grows in the tens and then hundreds of billions of dollars, marketplaces and liquidity protocols serve as a fundamental piece of infrastructure poised for success. If Rarible remains a top NFT marketplace in parallel with the expansion of NFTs, it will find itself in a beneficial position to continue its flywheel and establish greater network effects.