MetaPortal Research - Shining a light on WAX

Introduction

The Worldwide Asset eXchange (WAX) is designed to be the ‘King of NFTs’. It provides a marketplace for anyone to create and market NFTs, games and other decentralised applications (dApps). For example, celebrities including DeadMau5 and William Shatner, chose to release their NFT content on WAX. But it also acts as a platform for popular blockchain gaming apps like Alien Worlds and R Planet, both of which integrate popular play-to-earn features. When it comes to the tech, WAX is built on its own delegated Proof of Stake (dPoS) blockchain but links to Ethereum and EOS via a bridge.

WAX was created by the team behind OPSkins (OPS), an online marketplace for virtual items and gaming skins that ceased trading in 2017. The team moved on to launch VGO from the ashes of OPS in mid-2018, explaining in this blog post that the Ethereum network was unsuitable for trading in-game items and that a move to a purpose-built blockchain was the result of Ethereum’s scaling problems. Since that blog post in 2018, WAX has bridged back to Ethereum, where all their economic value now accrues in the WAXE/ETH liquidity pool on Uniswap.

Capturing a Trend

The WAX platform is an all-in-one hub integrating a wallet, NFTs and dApps. In its simplicity, WAX appeals to users looking for an intuitive and fun place to pick up collectibles. By partnering with major brands like Topps (Major League Baseball, Garbage Pail Kids) and Rarez (Weezer, Deadmau5), WAX has tapped into the mainstream collectibles market. This approach seems to be working too, with WAX reaching 3 million accounts created on 6th May 2021, just one week after passing the 2 million mark!

NFT drops taking place on WAX lean heavily on the fact that you can make purchases without the need to hold crypto. The lower energy footprint of the WAX blockchain is another advantage. Energy efficiency, in fact, takes up an entire section on their homepage and was even the subject of a recent grant aiming to make the blockchain carbon neutral. Interestingly, WAX is choosing a different narrative, prioritising ease of purchase (skipping crypto entirely) and energy efficiency compared to the Ethereum or Bitcoin networks. For new users to crypto, this narrative is easier to grasp. But there are trade-offs, particularly around self-sovereignty and network security. For instance, WAX has lower immutability than a network like Ethereum due to its centralised consensus mechanism and high barrier to running a node.

Aside from NFTs, dApps built on WAX may not get the most coverage but are consistently in the top 10 by sales volume, according to cryptoslam.

Other time frames paint a similar picture, with Alien Worlds and R Planet both consistently inside the top 10 with $18m and $6.3m in all-time sales respectively. Both are rather niche games that involve staking and/or mining NFTs. While their sales volume is large relative to other blockchain apps, it is unlikely that either will grow to be the next Minecraft. This is due to their relatively basic gameplay, combined with the need for crypto specific knowledge.

When it comes to the total addressable market, WAX has set its sights on two market segments. The virtual items from video games ($140b in total sales, $50b in secondary trading volume) and tokenised products from consumer e-commerce ($1.8tr of a $2.8tr e-commerce market). Their calculation of addressable market adds counts primary sales of video games/items and secondary virtual item sales because the WAX Platform supports both. It's worth noting, however, that WAX only earns fees on secondary market activity. Therefore, the subset of products WAX sees as tokenisable is $1.8 trillion of the $2.8 trillion e-commerce market. Taken together, that's close to a $2 trillion market size for digital goods.

Going mainstream

It hasn't been officially confirmed at the time of publishing, but there are reports that WAX blockchain is being used to support eBay's functionality for an NFT marketplace. This would be a monumental turn for WAX, throwing the project into the mainstream. Given the majority of eBay's activity comes from secondary sales, this integration can generate significant revenue for WAX, depending on the fee share arrangements. Keep in mind that so far, no details have been confirmed.

A secondary consideration is how the WAX blockchain handles a potential increase in transactions if eBay has a non-trivial impact on volumes. Current data shows that as of May, there were 11.39m daily transactions per protocol, according to DappRadar. This already dwarfs the figure of 427.6k from the Binance Smart Chain, which itself recently overtook Ethereum in terms of new users and has experienced significant slowdowns and downtime as a result.

Perhaps the most interesting comparison in the NFT space today is between NBA Top Shot on Flow and Topps MLB on WAX. While WAX may refer to themselves as the 'King of NFTs', nothing comes close to the $583m in all-time sales for Top Shots. That's over 10x more in sales than all WAX projects put together! WAX and Flow both have a similar fee model, taking a cut from secondary market sales. For Top Shot, it's 5%, split between Flow, the NBA and the National Basketball Players Association. In comparison, WAX takes 2% of all secondary market activity, described in more detail in the tokenomics section below.

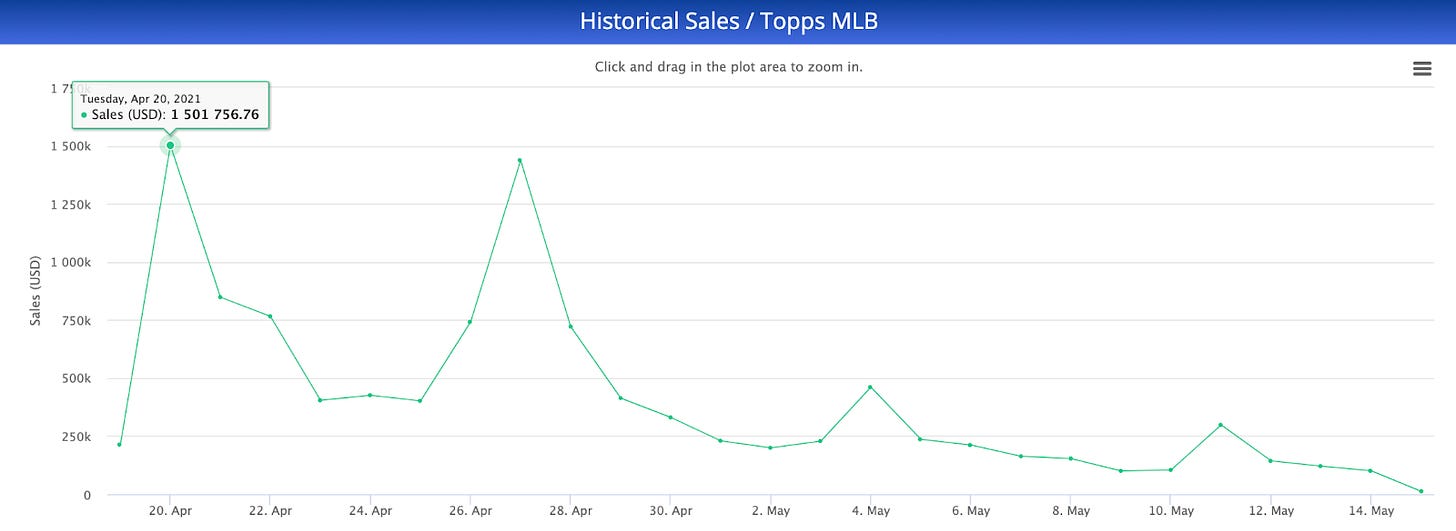

A deeper dive comparing sales volume since MLB's launch on 20th April shows both projects trending down during May, with Top Shot generating around $2m in daily sales and MLB struggling to stay over $500k. To an extent, the sales volume is affected by the popularity of the sports themselves. But after a successful launch, it looks like Topps MLB demand may be waning compared to the consistent activity for NBA Top Shot.

Looking beyond their deal with the NBA, Flow has also signed an agreement with Ultimate Fighting Championship (UFC) as it looks to capture the next popular market for NFTs. It hasn't been just plain sailing for the team though. During the exponential increase in users during February and March, the site struggled to keep up with demand, leading to long periods of downtime and withdrawal issues. On the other hand, WAX has many other Dapps and collectible drops running alongside Topps MLB. So far, it has coped with the rising demand without incident.

Quick Facts

Biggest sale Topps MLB - 04/22/2021 Mike Trout #1 sold for $87,672

Biggest sale NBA Top Shot - 04/16/201 LeBron James Kobe tribute dunk #3/59 sold for $387,600

Wax accounts > 3 million

Top Shot accounts > 1 million

Peak 1d volume Topps MLB - $1.5m

Peak 1d volume NBA Top Shot - $45.7m

WAX Fully Diluted Valuation (FDV) - $757m

Flow FDV - $33.8b

Tokenomics and Value Accrual

The tokenomics for WAX are fairly novel. The value derived from economic activity on one network (WAX Blockchain) is designed to accrue elsewhere (Ethereum blockchain). The flowchart below describes this cross-chain process.

To clarify the different tokens:

WAXP - the WAX Protocol Token. Economic activity on the WAX Blockchain produces WAXP denominated Network Fees.

WAXG - Ethereum ERC20 Governance Token.

WAXE - Ethereum ERC20 utility token.

In summary, WAX takes a 2% fee on all secondary market activity (e.g Atomic Hub, WAX Stash). The fees are taken in WAXP tokens, 20% of which are burned. The remaining 80% are converted to ETH, with half deposited into WAXE/ETH pool on Uniswap and the other half going into the WAXG 'Piggybank'.

Since deploying the updated tokenomic model on 8th January, WAX has distributed $423k in fees ($1.25m annualised) to stakers*. This equates to an 8% APR on the WAXE-ETH LP position at the current pool size of $16m, and a price/earnings** ratio of 280 at today's price of $224 for WAXE*.

*Figures correct as of 13th May 2021

**Using p/e as it is assumed that WAX costs are covered by the team using their token allocation, thus fees distributed to stakers are equivalent to a dividend.

The road to decentralisation

The process of decentralising WAX began in Jan 2021, with the launch of the new tokenomic model. The model awards liquidity providers with WAXG governance tokens, distributing control over certain aspects of the protocol into the hands of the community. The plan going forward is that WAXG holders will cast votes to govern the allocation and distribution of the WAX Economic Activity Pool (WEAP). WAXG will be used to vote on specific parameters of the WEAP, including Burn %, Distribution %, and PiggyBank %. There may be room for additional governance parameters as the system matures. For example, implementation of different liquidity pools or the length of staking periods. As of today, it's not possible to vote using WAXG as a governance portal hasn't been built yet. Furthermore, the team has mentioned de-prioritising it for the time being as they focus on other things.

Improvement proposals for the blockchain itself occur on the labs portal, where funds (currently totalling $36.5m in WAXP) are available to individuals or teams looking to further the WAX community or technology. The process is relatively simple, allowing anyone to create a proposal to claim funds toward an initiative. Initiatives that have been implemented include going carbon neutral and building a marketplace and analytics aggregator.

By taking the actions outlined above, WAX is beginning to decentralise both governance and development of its blockchain. There is still a long way to go for the 3-year-old project. Still, the updated tokenomics and incentives for external involvement are certainly a step in the right direction.

Conclusion

By abstracting away the complexities of managing a wallet and building a simple hub for all purchases, content and dApps, WAX unquestionably appeals to newer and less experienced crypto users. This is reflected in the recent growth of new accounts as NFTs become a hot topic, and the consistently high sales volumes originated by WAX dApps.

With the rumoured eBay partnership, WAX stands to continue its recent rise from a relatively niche offering into a genuine competitor for Ethereum transaction volume. This will undoubtedly lead to more scrutiny around the blockchain's decentralisation and consensus model, but if BSC is any indication, it won't hamper adoption in the short term.

So while WAX token trades at a very high P/E multiple, the project itself is growing in both users and sales volume, as evidenced in several metrics. In the short term, partnering with a huge marketplace like eBay could add fuel to the fire and catapult WAX into being a serious alternative to better-known blockchains like Ethereum and Flow.