MetaPortal Research - YGG and the Gilded Age

This post is brought to you by…

NFTfi allows borrowers to put up assets for a loan and lenders to make offers in exchange for interest. The NFT is held in escrow so lenders know for sure that they will either get their money back with interest, or receive the NFT in exchange.

Earlier this month, we added the Yield Guild Games token to the Metaverse Index. YGG has been referred to as the Berkshire Hathaway of the metaverse, the Uber of the metaverse, the job board for the metaverse, among other things. The time has come for us to take a closer look at the project in what, we hope, has now become one of our patented deep dives.

YGG is most commonly known for pioneering the scholarship model in Axie Infinity and was built to extend this model across the entirety of the play-to-earn space. Another exciting innovation coming from YGG is the subDAO model, allowing the formation of many guilds within YGG and aligning all stakeholders using a subDAO token. We explore these two innovations in detail as they are, in our opinion, two of the main factors behind YGG’s present and future success.

During our research, we examine YGG’s treasury, governance structure, roadmap and also pose some questions that, so far, haven’t been sufficiently answered in public documents. Strap in, and let’s go for a ride.

Revisiting NFT gaming

Before we get into YGG, it’s worth talking a bit about the NFT gaming space. We wrote about NFT gaming nearly 6 months ago, highlighting the benefits offered by NFT games relative to traditional games, particularly the economics and the ownership aspects. We also wrote about the rise of play-to-earn and the social factors that power it.

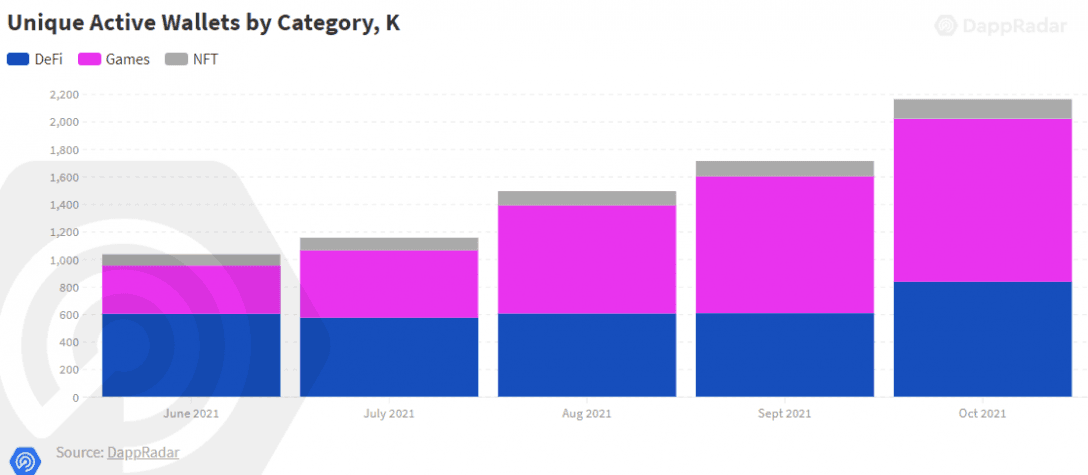

Fast forward 6 months and, according to DappRadar, NFT games represent 55% of the activity across all dApps.

It’s not just Axie Infinity anymore either. After launching its token, Splinterlands grew 3,260% in Q3 and saw 651,000 unique active wallets (UAW) in October. Games are popping up on every chain, from Binance Smart Chain to Solana to Polygon. And money is flowing into the space, with Bitkraft raising a $75m token fund for NFT games and a16z making investment into Sky Mavis and Yield Guild Games.

A mandatory reminder for those unfamiliar with gaming – it’s a $175bn a year industry with 3.2bn gamers worldwide, growing rapidly. That’s a big market to disrupt and it will only get bigger as metaverse takes shape. Now that we have set the stage, let’s think about YGG and its place in the gaming ecosystem.

What is YGG and what does it do?

The YGG team fundamentally believes that digital economies will, over time, be much more valuable than IRL economies. Based on that, YGG wants to own as many productive digital assets as possible. This could be governance tokens, in-game items, land and so on. So far, YGG has gravitated towards games, given a relatively straightforward path to income generation from game assets.

That’s one side of YGG, the side that aggregates metaverse assets on its balance sheet. As an investor, it makes sense that YGG would also want to contribute to developing these assets. For example, it can do so in an advisory capacity, but perhaps more importantly, it can seed the initial player liquidity. That’s the other side of YGG – aggregating gamers.

What YGG does is match the assets on its balance sheet with gamers in its community to generate income from those assets and optimise them through in-game decisions. See, YGG is not a guild. Instead, it’s a platform for guilds. It allows guilds to borrow assets from the balance sheet and provides them with tools and technology for governance and incentive alignment through tokens. That’s the subDAO model that we will discuss later.

To illustrate how this works, let’s use Axie Infinity. You need 3 Axies to play Axie Infinity. By playing, you can earn SLP, the in-game token that can be exchanged easily for ETH or fiat. At the end of September, YGG had 26,438 Axies on its balance sheet, and it lent out 14,130 of them to 4,710 players, who in turn began to generate income from those assets. As part of YGG’s model, players keep 70% of the total revenue, YGG takes 10%, and 20% goes to the manager whose job is to find, educate and help scholars.

Beyond just numbers, YGG is making a significant impact across SEA by providing economic opportunities to those who want to play Axie Infinity. Depending on the price of SLP and the strength of their Axie team, players can generate income that is higher than what they can get in entry-level jobs in their respective countries.

Tokenomics

Looking at the token, the maximum supply of YGG is 1,000,000,000, which was allocated to different participants in its ecosystem. Approximately 42% went to the team, investors and advisors. The rest was split between the community Treasury at 13% and the community itself. According to the whitepaper, the community tokens will be “distributed to the DAO community members through its various community programs.”

The lockups and vesting schedules for the team and investors are reasonable and long-term oriented.

The whitepaper states that the Treasury allocation has “no lock up period and no vesting conditions” while the Community allocation will be distributed over 4 years. The main categories for the Community allocation are:

Retention – 29% or 130m tokens

Levelling-Up rewards

Onboarding rewards

Random and Seasonal rewards

Bonus for Esports participants

Loyalty rewards

Staking rewards – 22% or 100m tokens

Contributor rewards – 18% or 80m

The team also has plans for new game airdrops and other conversion and acquisition initiatives to attract new players and build out the player liquidity it can use to see new games.

Alright, so when you buy the YGG token, what are you actually getting? And how is the token designed to accrue value?

First, you are getting exposure to all the assets on YGG’s balance sheet, including in-game items, land, liquid token holdings and illiquid token holdings from YGG’s investments into projects. You also get exposure to the revenue streams generated by the protocol. This could come from guild members generating income from gameplay and management of the game assets. Or active treasury management like staking AXS or LPing AXS/ETH for RON rewards as well as any future revenue streams from esports, merchandise sales, sponsorships, etc.

What’s in the treasury?

Now let’s look at the balance sheet. The latest data we have is from the September Asset & Treasury Report published in late October. The balance sheet is broken into 3 broad categories: liquid tokens, metaverse assets and illiquid tokens.

On the liquid tokens side, YGG held $815m worth of tokens, with 96% of that being the YGG token itself. The report shows around 127m YGG tokens in the Treasury, which we assume is the 13% Treasury allocation from the initial distribution. There’s also about $14m each of USDC and AXS, plus $4.5m of ETH. The total for liquid, non-YGG tokens in the Treasury is $33.4m.

The total across metaverse assets was $17.6m at the end of September, spread across 12 games and 36,712 assets.

The illiquid tokens stood at $6.6m at the end of September. Since then, YGG executed several token swaps with projects like RedFox, Aavegotchi and Mobox, and strategic investment into Merit Circle.

YGG has so far done well making early-stage investments in games, virtual worlds and gaming platforms. Since the end of September, Merit Circle had its public sale through an LBP and is sitting at a $6.1bn fully diluted valuation at the time of writing. While we don’t know what the seed round valuation was, we assume YGG generated a stellar return on that investment as well.

Looking at the revenue from current games and assets, Axie Infinity is the only game currently generating revenue for YGG. However, YGG continues to spend considerable resources on breeding new Axies that significantly outweigh the revenue generated. In September, YGG earned $124k while spending $848k on breeding. Earlier in the year, in July, YGG generated $326k while spending $1.6m. The team is also not prioritising or optimising the cost of their breeding activities, preferring to breed the same pair 5-7 times. The cost of the later breeds is 3-4x their market price.

We understand that YGG’s goal is to grow the scholar base as fast as possible, and the team has no intention of ever selling the Axies. However, we wonder if there’s a more economical way to do this. We are also not sure this level of breeding is even necessary. While YGG has over 26,000 Axies, only 14,130 were being utilised by scholars at the end of September. YGG scholars have to be managed by one of the community managers. Based on the latest information we could find from Gabby’s podcast with Anthony Pompliano at the beginning of October, YGG has 19 community managers. We have certain worries about how scalable this model is and if, perhaps, YGG should consider a somewhat more permissionless scholarship structure that allows non-YGG managers to borrow assets from the balance sheet.

A bit of a side note here, but YGG also generates income from the royalties on the secondary sales of the YGG Founders’ Coin. Up till the end of September, that brought in $381k, although the volumes have dropped off a bit recently.

Turning to the token holder’s perspective, the real value-add here is the exposure to early-stage projects through Simple Agreements for Future Tokens (SAFTs). The team has over $800m of YGG token in the Treasury that it can deploy into games. We have seen a flurry of announcements in September and October about the team investing in land, in-game assets, doing token swaps and SAFTs. However, it’s challenging to see anyone being able to deploy $800m into what is still a very nascent market of virtual worlds and NFT gaming. With that in mind, we believe YGG needs to prioritise diversifying its Treasury and making it productive. Token swaps work fine in the bull market but not so much when the music stops.

The investment side of YGG is very similar to a VC firm that brings capital and player liquidity. However, the YGG token is not valued at the NAV of the underlying assets. Instead, the market determines the price, which can lead to significant deviations from what the underlying assets are actually worth.

Who is doing the governing?

While YGG calls itself a DAO, it’s structured much more like a traditional company. For example, Treasury decisions are made by the three co-founders and executed via a 2 out of 3 multi-signature Gnosis wallet. Unless anything changed since the whitepaper was published, that’s 2 people able to allocate $800m from the Treasury. Also, as far as we understand it, the SAFTs mentioned above require either a legal person or a legal entity to enact. They can’t be done as a DAO. This means either a legal YGG entity is registered somewhere that owns all those tokens, or those investments are made by one of the three co-founders in their individual capacity. Either way, in the case of legal action or enforcement, these tokens can be confiscated.

For the time being, there is no governance mechanism at the YGG level. The team is focusing on building out infrastructure and governance at the subDAO level, but in terms of YGG itself, product and investment decisions are made by the founders and the team.

We generally think that retaining centralised control until the product is close to finished and decentralising governance at that point is the best way to build a DAO. It allows a project to move fast and avoids decision-making and human coordination problems. However, what we have seen in the space is a lot of teams promise decentralisation but significantly delay the execution, remaining highly centralised. Community members certainly have an opportunity to participate and benefit from the growth of a project through rewards and other mechanisms but don’t have much say in governance.

From our perspective, YGG is currently neither decentralised nor autonomous. The more significant concern here might be that 2-3 people are making investment decisions, albeit with help from the investment team, with nearly $1b in capital. This structure makes YGG holders more akin to limited partners in a token investment fund than holders of a proxy gaming NFT index.

Innovating with the subDAO model

While YGG is centralised at the top level, the subDAO structure allows for the decentralisation of the individual game guilds. We find the subDAO model fascinating and highly innovative. Here’s how it works.

Think of subDAOs as guilds formed from YGG community members aligned around a specific NFT game or geography. When a subDAO is created, YGG puts assets for that particular game, Spliterlands, for instance, into a hardware wallet and enables the subDAO community to control those assets through smart contracts. The wallet is then fractionalised with tokens distributed to subDAO members, active game players, YGG itself, and the subDAO Treasury.

There are several important aspects here. The subDAO tokens are meant to represent the monetary value of the underlying assets. They don’t, however, represent ownership of those assets as YGG still retains the ownership. So the primary purpose of the subDAO tokens is governance over the in-game assets and revenues generated from them. Theoretically, the subDAO can choose to distribute income to the subDAO token holders, invest in other tokens, convert Treasury into stablecoins to create passive income, and so on. SubDAO tokens are, essentially, social tokens representing their respective communities. Regarding value accrual to the YGG token itself, as distribution of the income generated by the subDAO is subject to governance, the only viable value accrual mechanism is price appreciation of the subDAO’s token.

Overall, while the subDAO model is highly innovative, it effectively trades in the passive income from game assets for capital appreciation of subDAO’s tokens. Neither good nor bad in itself, we nevertheless wanted to point out this aspect of the subDAO model.

In terms of the genesis distribution of a subDAO’s token, there are no standard terms for the time being. The most recently proposed subDAO, YGGSPL for Splinterlands, put forward the following distribution which essentially allocated 10% for YGG Treasury, in line with the 10% cut YGG gets from the Axie scholarship income. But in the case of the subDAO, no direct income is flowing back to the main Treasury, unlike with the scholarship model.

On the other hand, introducing the subDAO token gives plenty of incentives to guild members and players and aligns those incentives between YGG itself and the subDAO. Overall, we see subDAOs as a fascinating experiment and will closely follow their evolution, focusing on governance, alignment of incentives and financial consequences for subDAOs themselves and YGG.

The promise of YGG Vaults

Before we wrap up, it’s worth briefly discussing YGG Vaults. While they are not live yet, they will add utility to the YGG token once developed and deployed. Simply put, Vaults will allow YGG tokenholders to receive income from specific YGG activities. There will be, for example, a vault for a particular game or a Vault for merchandise and promotional revenue. YGG holders will be able to stake YGG into one of these Vaults and receive a share of the income from that specific activity. There will also be an overarching YGG Vault, where YGG holders will get a percentage of the revenue from all of YGG’s activities.

The overall structure of Vaults and subDAOs, coupled with the legal design of YGG itself, is quite complex. For example, we assume that vaults will not be possible for games operated by a subDAO because subDAO’s income distribution is subject to governance. So it’s challenging for us to forecast how all these things will interact with each other.

Summary

To sum things up, YGG is a pioneering project that we believe will eventually own assets in every single viable play-to-earn ecosystem in the metaverse. YGG’s ability to invest in in-game assets, virtual real estate, and governance tokens at pre-public valuations perfectly complements the otherwise passive nature of the Metaverse Index. We view it as adding a play-to-earn focused hedge fund to a passive ETF.

We see YGG having a strong product-market fit stemming from its ability to provide capital with little red tape or oversight and having the ability to seed player liquidity for new games. We believe this will enable YGG to get plenty of opportunities to allocate its capital.

While there are some open questions about the structure and governance, we think the team is communicating their intentions well and has demonstrated the ability to deliver on their stated roadmap.