Metaverse Index Monthly Update - April 2021

This is the first monthly update for the Metaverse Index (MVI), and we are excited to share our thoughts with the community.

As we tend to do at Index Coop, we launched MVI at somewhat of a local top, just as the hype around NFTs and the metaverse was getting unbearable. This timing certainly played a role in the performance of MVI since its launch on April 7th. As the space cooled off, MVI returned -7.6%, underperforming ETH, BTC and DPI.

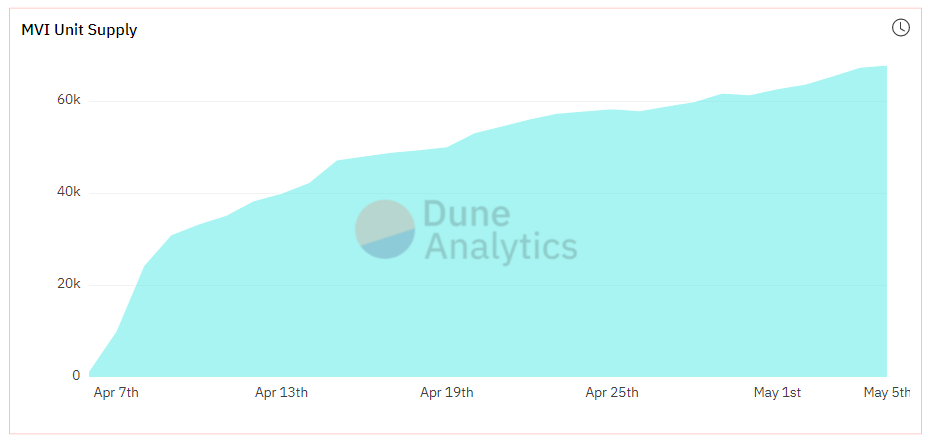

Despite the challenging performance, MVI saw strong growth in the number of holders and unit supply. There are currently over 1,100 addresses holding MVI, and unit supply is at ~68,000 units.

Looking at the performance of the underlying tokens, 11 out of 15 delivered negative returns between April 7th and April 30th. Interestingly, the underperformance was concentrated in the smaller cap tokens. MUSE, MEME, NFTX and RARI, all with market caps below $100 million, pulled back after a solid start to the year. Most of these tokens registered gains between 120% and 670% in the two months leading to the MVI launch.

Underperformance in the small caps was partially offset by a strong performance from the large caps in the portfolio. ENJ and MANA, for instance, returned 18.5% and 55.2%, respectively, while WAXE and AXS gained 22.1% and 31.3%.

Top Performers

Decentraland’s MANA token had a barnstorming April, gaining 55.2% and contributing the most to MVI’s overall performance. The month started strong with DCL announcing the ability to port MANA from Ethereum to the Polygon network (a layer 2 scaling solution), making marketplace transactions for wearables free of transaction fees. With a further update in May, both the Builder and Marketplace will support Polygon, meaning new wearables and scenes can be minted without the impediment of high transaction fees.

In terms of events within the world itself, the team kicked off the month with a 5-day conference centred around NFTs and ended it with the launch of the Atari Casino in partnership with Decentral Games, with world-renowned DJ Dillon Francis providing the entertainment! The usual entry point to the world, Genesis Plaza, got a refresh too. Users arriving in Decentraland now have a much more straightforward choice of where to go, being presented with games, live events and even a social area to meet other users and hang out.

While MANA was the top performer during April, the token wasn’t immune to the broader cool-off in the metaverse/NFT sector. It lost almost 50%, going from $1.56 down to $1.04, in the middle of the month. What separated MANA from other tokens was the ability to recoup most of those losses. Being one of the longest-running projects (Oct 2017) and having a large market cap certainly helped. Marketplace fees (realised as MANA token burn) came in at $120k for the month, with Land and Estates accounting for 98% of that volume.

AXS, the governance token for the Axie Infinity ecosystem, was another strong performer in April. This was driven by a mix of fundamental and sentiment factors. On the sentiment side, or maybe CT hype side, a tweet from Bored Elon Musk, rumoured to be Musk’s alt account, acknowledging the existence of Axie Infinity sent AXS price soaring to $11.54 on April 20th. Yup, I never thought I’d be talking about tweets in my financial performance commentary.

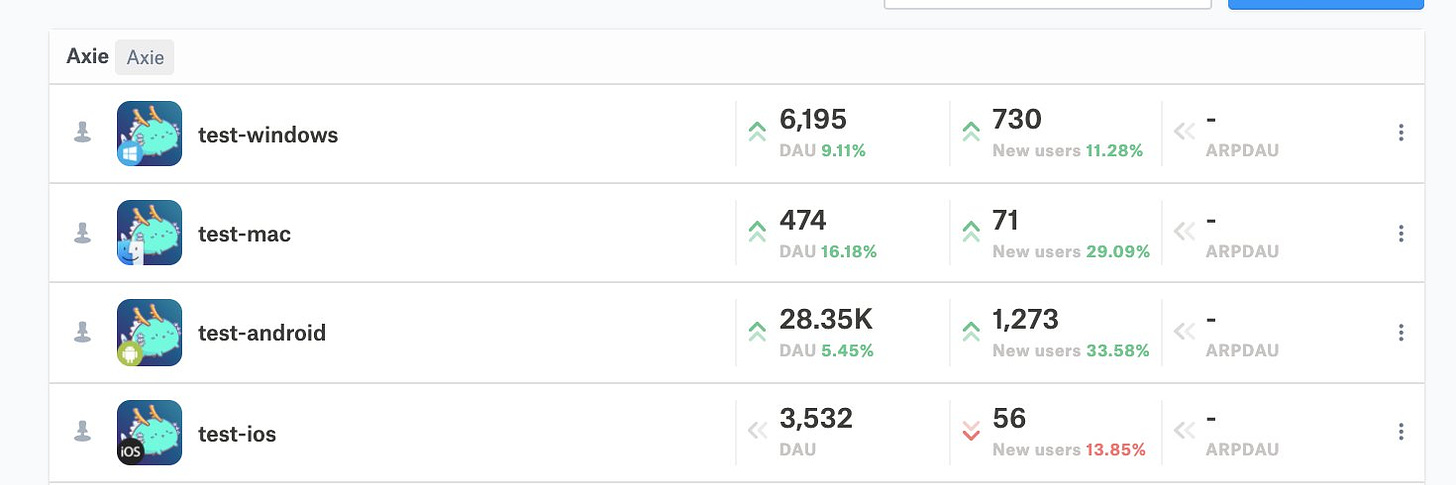

On the fundamental side, Axie finally launched the next phase of migration to its own sidechain of Ethereum, Ronin. This is a big deal. Ronin will remove some of the growth constraints the team has faced and markedly improve the user experience. Expect lower costs of getting started, cheap transactions, much more Axie breeding and, generally, higher user activity. In fact, Axie is getting pretty close to 30k daily active users across various platforms.

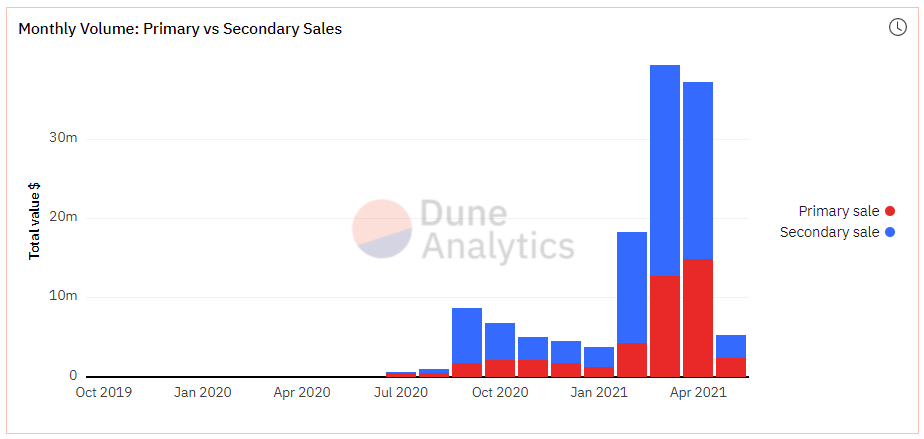

As of May 5th, or about 7 days since the migration went live, around $11m has been moved to Ronin. Axie generates revenues from breeding and marketplace fees, as well as land sales. In 7 days on Ronin, Axie generated 13,338 AXS (~$115,000) from breeding fees and 67 ETH (~$225,000) from marketplace fees. That’s $340,000 in one week and $18m annualised. No wonder the token had a good month.

Performance Detractors

One of the tokens that underperformed during the month was RARI. After hitting an all-time high of $46.7 on March 29th, RARI was still trading well above $40 at the time of the MVI launch, an increase of nearly 350% over the previous 2 months. Looking at the fundamentals, the protocol continued to see strong monthly volume in April, with an increase in the average check size from $956 to $1,531.

The team also released timed auctions, which you can learn about here. Meanwhile, the community was busy on the governance and org side of things. One of the votes that was passed by the community reallocated 25% of the marketplace mining fund to the Community Treasury. The next steps on the journey to decentralisation involve adding snapshot quorum and enabling delegation as part of Phase 2 and RARI staking as Phase 3. Staking RARI will result in the creation of Activated RARI and will be subject to a lockup period. Only Activated RARI will be used for voting and will enable the protocol to transition from the “Signaling Era” to the “Autonomous Era”.

RFOX was another underperformer during April, despite its market cap of over $350 million. After enjoying a steady run-up in price from $0.02 in January to $0.37, the token gave up a share of its gains in April. Price retraced to as low as $0.21 before finishing the month 28% down at $0.23.

There were many catalysts for the initial run-up, including the announcement of RedFOX lab’s new virtual space, the Valt. This was coupled with a full tokenomics revamp, which introduced a brand new (Binance Smart Chain based) token, VFOX. VFOX gives holders a share of the fees generated within the Valt, with RFOX staying as the centre point of the RedFOX games ecosystem.

Despite all the updates and a completely new venture, RFOX wasn’t immune from broader market dynamics. With a brand new token in the mix and farming on BSC, it remains to be seen if RFOX can continue to grow at the rate it has since the start of the year.

Summary

Over the last couple of days, we have successfully rebalanced MVI in line with the methodology. Engineers at Set Protocol have tested their new General Index Module for rebalancing, which uses oracles to prevent MEV attacks.

Relative to portfolio allocation at inception, we have increased exposure to MANA, AXS, ENJ, WAXE and SAND at the expense of other tokens. This was due to the increase in their market cap associated with price outperformance during the month.