Metaverse Index Monthly Update - December 2021

This post is brought to you by…

NFTfi allows borrowers to put up assets for a loan and lenders to make offers in exchange for interest. The NFT is held in escrow so lenders know for sure that they will either get their money back with interest, or receive the NFT in exchange.

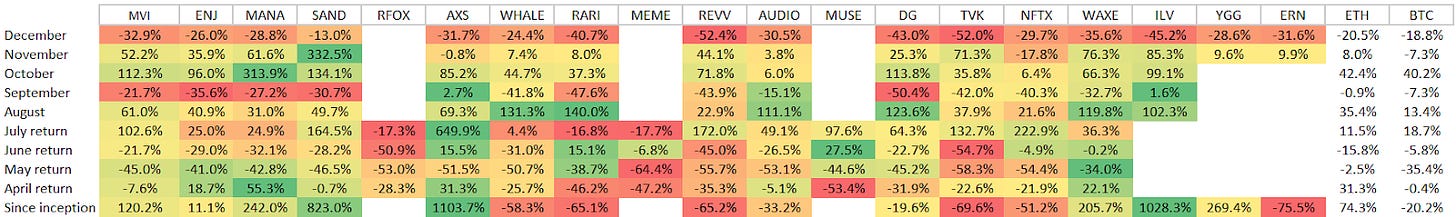

After two months of hype, price gains and near-endless mentions on earnings calls and in the traditional media, the Metaverse narrative has cooled off a bit in December. More broadly, though, the fourth quarter hasn’t quite lived up to its reputation from previous crypto bull markets. BTC was down in November and December, while ETH eked out a small gain in November but underperformed BTC in December. Not quite the storybook ending to the year many were expecting.

Against that backdrop, MVI held up quite well, down 32.9% in December but still up over 100% in the fourth quarter. Since its inception, MVI continues to outperform ETH and BTC by 46% and 140%, respectively.

Stats and sats

Risk metrics remain essentially unchanged. MVI’s correlation to ETH and BTC is at 0.73 and 0.66 since inception. The MVI’s beta to both is currently at 1.07 for ETH and 1.29 for BTC. Net capture ratios remain positive. For BTC, net capture was down slightly in December, from 47.6% to 40.7%. While for ETH, the net capture ratio improved, from 8.7% to 12.2%.

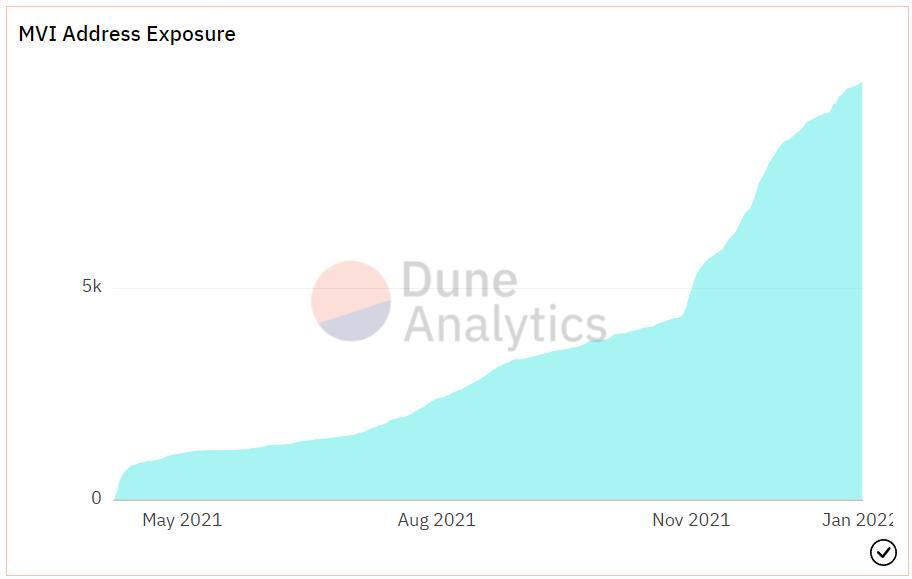

The growth in the number of unique addresses holding MVI moderated in December, up 21%. We added 1,735 holders, with a total of 9,833 holders on Ethereum and 3,189 addresses holding MVI on Polygon (92% growth in December).

Unfortunately, we cannot determine the level of holder overlap between Polygon and Ethereum, as the MVI on Ethereum is sitting within the Polygon (Matic): ERC20 Bridge. The Polygon bridge is now the single largest holder of MVI, currently holding ~4.5% of circulating supply and rising.

While holders continued to grow steadily, unit growth was non-existent in December. In fact, units circulating actually fell by 795 or -0.40%, the first monthly drop since inception despite the strong growth in new addresses. Liquidity for MVI itself continues to be challenging, and in the absence of liquidity, we continue to rely on retail buyers, usually buying and holding less than $2500 of MVI. Given these dynamics, it’s challenging to see strong unit growth in the near term, barring another narrative hype cycle.

Trading volume has cooled off as well. After averaging $2.5m per day in November, December saw an average of $1.05m traded daily. This generally confirms the signs of some exhaustion around the Metaverse narrative at this time.

Metaverse – where do we stand?

For the last couple of months, we’ve been highlighting what we thought were unsustainable valuations in many Metaverse tokens. It is no surprise that the space has pulled back, and we expect it might take a few months to reset. The capital has now shifted to the next story.

Narrative-wise, alternative L1s continue to perform well, specifically the ones with a bit less hype, like Cosmos and Near. We have also seen DeFi 2.0 emerge as a pretty strong meme that began to outperform and pull some of the DeFi 1.0 names with it. Same for tokens adopting the veToken model.

We have seen this before, though. The previous hype cycle in the NFT and the Metaverse space was in March-April of 2021. In fact, 7 out of the 15 tokens currently in the MVI have never reached or exceeded their previous all-time highs during this recent run-up. From the projects that made new ATHs, most benefited from strong project-specific drivers and the overarching narrative. Here’s a quick summary:

AXS – Ronin and massive growth in DAUs.

ILV – the ambition of the team (first AAA NFT game) and ongoing, never-ending communication about the game's development process.

SAND – release of the alpha, new partnerships with big names on IP and land sales.

WAXE – growth of the carbon-neutral ecosystem, Alien Worlds, NFT activity spike.

DG – ICE poker, 100k MAUs, continued execution by the team.

YGG – hitting 10k Axie scholars, ongoing capital deployment across the P2E ecosystem, community growth, funding round led by a16z.

MANA – 500k MAUs, Metaverse festival with 50k concurrent users and 1.5m unique active users in total during 2021.

ENJ – tech stack development, winning a Polkadot parachain slot for Efinity, 18.7m registered gamers in the Enjin ecosystem.

Another interesting trend that has emerged in the recent rally was the preference for gaming and virtual world projects at the expense of the other parts of the Metaverse ecosystem.

Marketplaces, RARE and RARI, have underperformed. NFTfinance names, MUSE and NFTX, have done poorly. Collectible projects like TVK, ERN and SUPER, have not benefited either.

We expect that to change. NFTfinance is likely to see strong growth in 2022 with NFTX, MUSE, Factional when they eventually launch a token and Unicly. The rental market for NFTs is also developing, and while 2022 might still be early for that, the narrative will inevitably fuel interest and speculation. Marketplaces are the easiest way to play the growth of the NFT ecosystem. We expect to see music marketplaces (Catalog, Royal), 3D object marketplaces (MetaMundo) and others emerge in the new year. In the media and entertainment category, Audius led the way in 2021, and more projects will leverage NFTs and blockchain technology to disrupt movies, television, publishing, advertisements, etc. Verasity and Opulous are just some of the examples.

Overall, we expect 2022 to see a lot of innovation, new project launches and, perhaps, a couple of price cycles taking us to new highs.

Gaming index

To circle back to gaming and virtual worlds, we are working on a dedicated gaming index product and plan on launching it soon. The Metaverse Index was not created to track the gaming ecosystem, and we feel it's being pulled increasingly in that direction due to price and liquidity dynamics in the space.

The gaming index will focus exclusively on gaming, while MVI will retain its focus on the broader Metaverse narrative and will work on diversifying its sector exposure through new additions.

We will be launching our Discord shortly if you want to learn more. Keep an eye out for a Twitter announcement.

Closing Thoughts

In December, we wrote several articles about MetaPortal, including our vision for it and the investment thesis for our angel investments in the space. We also wrote about MetaPortal Metaverse categories. And, of course, we continued to go through Matthew Ball's "Metaverse Primer". Dropped an episode of "Probably Nothing" in there too.

Last but not least, this month, we added the Rally token (RLY) to MVI. Rally is a platform that allows anyone to create a social token, even without prior experience using crypto. As a platform, it fits neatly into our recently announced definitions of Metaverse token categories. When considering the composition of MVI, we felt that including individual brand / community / personal tokens doesn't fit MVI's mandate and will become more difficult as they proliferate in future. However, social tokens do allow anyone to form a digital bank account around their reputation and build a community from scratch. This is a textbook definition of life moving to digital environments powered by blockchain and NFTs. Having Rally as a 'social token aggregator' of sorts allows MVI to capture this segment without the challenge of choosing between the thousands of social tokens themselves.