Get liquidity for your NFT now via NIFTEX

Build new communities around your NFTs/Land and unlock liquid NFT markets with NIFTEX fractionalization. Try it out here!

Another month is in the books for MVI. While absolute performance continues to be challenging, we see it as in line with our expectations. The metaverse space is incredibly early in its development, and there will be a lot of volatility along the way. During bearish or sideways markets, the MVI should underperform more established assets like ETH and BTC, as well as DeFi. At the same time, an index product is meant to smooth out some of the volatility of the underlying tokens and have a more balanced return profile. That’s precisely what we see with MVI.

Looking at the monthly performance, MVI returned -21.7% in June, underperforming BTC and ETH, which declined by 5.8% and 15.8%, respectively. Since its inception, MVI is down approximately 60% compared to -39.4% return for BTC and 7.8% for ETH. We did some digging into our tendency to launch products at local tops and confirmed that most MVI tokens peaked at the end of March or early April. MVI launched on April 7th, so, as unfortunate as it is, the since inception performance is understandable.

Digging deeper into the performance and risk data, we see that MVI is more correlated with ETH than BTC at 0.84 vs. 0.74, respectively. At the same time, MVI’s beta to BTC is 1.35 while its beta to ETH is only 1.05. Looking at the upside and downside capture ratios further highlights that relationship. Since its inception, MVI has captured 132.9% of BTC’s upside and 135.3% of BTC’s downside. So it’s more volatile on the way up and down, leading to a higher beta to BTC. For ETH, MVI is capturing only 83.3% of the upside but 121.5% of the downside. This was particularly painful in April and May, as ETH was hitting new ATHs almost daily.

MVI by the numbers

As per usual, we wanted to highlight some of the analytics and non-performance-related MVI data. MVI unit supply continued to grow during June, albeit at a slower rate. Relative to 20,000 new units minted in May, June saw the creation of roughly 11,500 new units or a 15% m-o-m increase. The number of new addresses holding MVI increased by 250 in June, similar to the rise in May. Overall, more than 1500 addresses now have exposure to MVI.

Retention rates remain strong, with almost 90% retention for the June cohort. We are also seeing increased demand from small holders as addresses buying under ten units of MVI (under $400) increased substantially in June. Almost 55% of all units are held without any incentives. That number is near 85% for DPI, and we expect MVI to trend in the same direction over time.

Portfolio performance

Despite a negative performance month overall, some MVI tokens managed to deliver strong returns. MUSE, AXS, and RARI rallied by 27.5%, 15.5%, and 15.1%, respectively, while WAXE and NFTX also outperformed the broader market. RFOX and TVK were notable underperformers, dropping over 50% in June.

Taking a closer look at the tokens, we think it's worth touching on MUSE yet again. We covered it last month, but this project is still flying under the radar despite strong performance and solid fundamentals. The team deployed their NFT DEX on Polygon in May, and in June, they received a grant as well as a promise of tech and marketing support from Polygon to keep building and growing on the network. Fundamentally, NFT20 is seeing increased usage with steady growth in actions per day.

There were also some exciting developments on the token economics side. NFT20 doesn't charge swap fees, but it does take a 5% fee when a given NFT is tokenised. The fees are taken in a newly created ERC-20 representing that NFT, so $MASK20 representing a tokenised Hashmask, for example. A few weeks ago, a proposal to swap some of those fees into ETH during a user transaction passed with overwhelming support. That ETH is then used for on-market buyback of MUSE, and the acquired MUSE is distributed to MUSE stakers. Since these changes went into effect on June 17th, the protocol bought back roughly 5,900 MUSE, and there's currently 108,000 MUSE staked. We'll let you do the math, but these are pretty good yields.

If you don't want to listen to us, though, here's a well-researched thread by an analyst at Defiance Capital who have recently invested in MUSE.

Another token that did quite well this month is AXS, and it should come as no surprise to MetaPortal readers that we are huge fans of the project. There has been quite a lot of coverage recently on Axie Infinity, and we will not try to reinvent the wheel here. This article by William Peaster sums the developments rather nicely.

What we do want to do is share some stats.

For example, the game now has 350,000 daily active users, up from 15,700 on January 1st. This actually makes Axie the most used app in crypto. Period.

Axie Infinity has a 30-day retention rate of 90%. We are no experts on gaming retention rates, but a casual google exercise yielded a range of somewhere between 4%-6%. You might call it product-market fit.

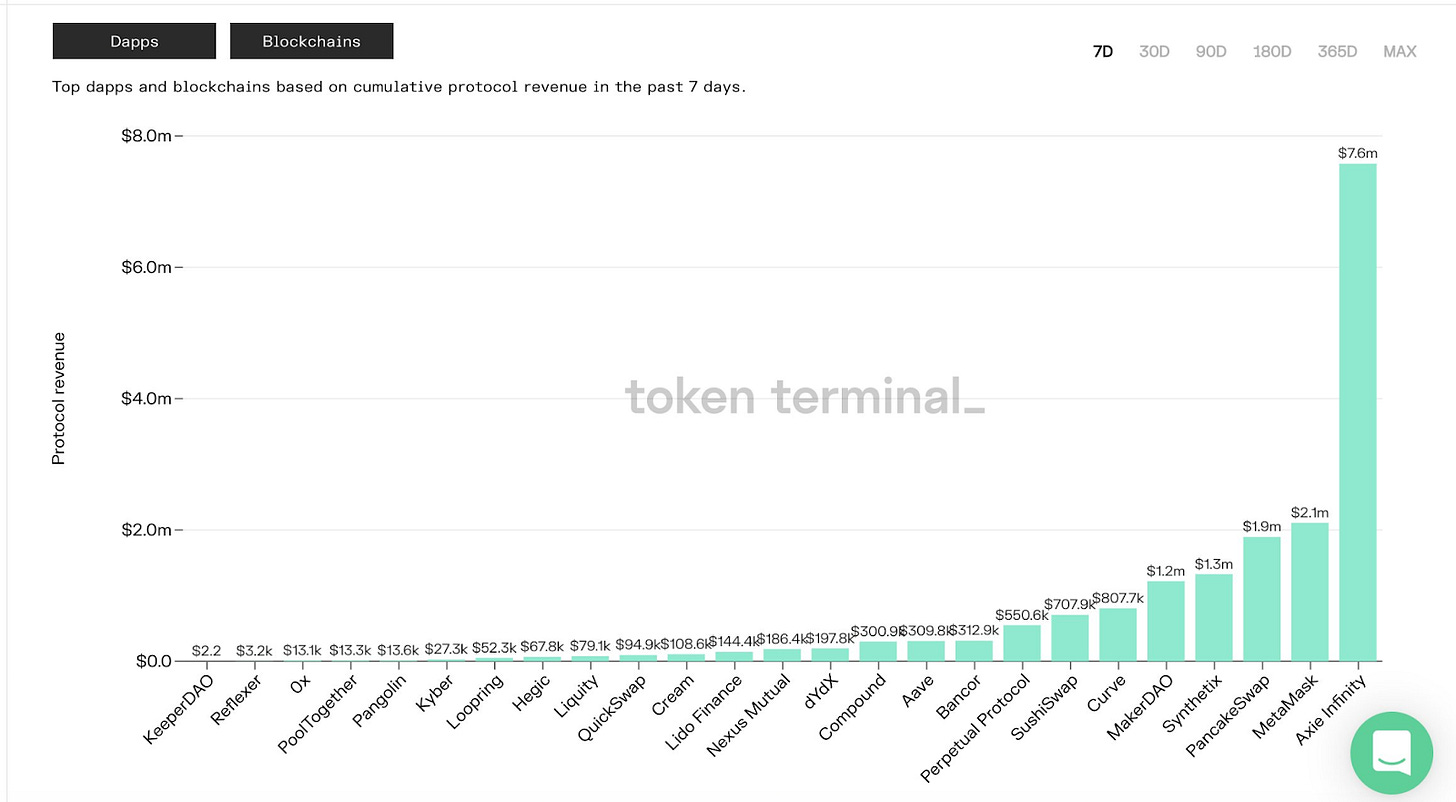

This chart from Token Terminal has been making rounds and doesn't need much explanation. We've been talking about the revenue run rate for Axie Infinity for several months now, and it's only going to get better from here (the breeding fee just increased by 100%).

Trading volume is part of the revenue picture as Axie takes a 4.25% transaction fee. But 325% growth over the last 30 days is quite stunning, as is Axie's place as the top marketplace in crypto.

On the less positive side, a tough month for the $TVK token saw it lose 54.7% and come in as the worst performer in the index. Unlike the market-wide sell-off that hit the space in May, the June underperformance was limited to fewer tokens, exposing projects like Terra Virtua.

The team had been teasing interoperability at the start of the month, and midway through, rolled out the ability to migrate NFTs outside of the Terra Virtua ecosystem to any ETH address. The second-order effect here is that TV items can now be traded on marketplaces like Rarible and Opensea for the first time. Landing on popular marketplaces is a big step for the project and could help grow awareness. For the time being, however, value accrual to the token remains limited. It still has loyalty benefits within the ecosystem, but $TVK won't accrue value from extra activity taking place on these new marketplaces. We will be watching NonFungible to monitor activity levels for TVK items and quantify the impact of interoperability.

It also looks like Terra Virtua is attempting to scale the community and spread the word about their project. With the launch of an ambassador program and two new vacancies on the website, including a community manager role, expect to see more TVK content on your social media platform of choice.

So the theme for June was breaking down the walls, both from a technical and social standpoint. This alone wasn't enough to keep the token price from crashing, and it remains to be seen if these actions will have a positive effect on the token in the immediate future.

As we tend to, we wanted to highlight several other research pieces that we published in June. In the most recent article, we talked about the memetic power of play-to-earn and the social dynamics behind tokens. Several weeks prior, we covered Decentral Games and were also joined by the project's Chief of Operations, Ryan, on the MetaPortal podcast.

Summary

Last week, we successfully rebalanced MVI in line with the methodology. Relative to portfolio allocations at the previous rebalance, we have increased exposure to AXS, RARI, and MANA. The first two outperformed, while MANA benefited from an increase in its liquidity courtesy of the relatively new Sushiswap pool. At the same time, portfolio allocations in RFOX, TVK, and ENJ were reduced. There were no new token additions in this month's rebalance.

That Axie growth is outstanding! Is it really all down to putting the game on Ronin? Is, perhaps, an interesting augur of what else L2s and 'sidechains' might do to the ecosystem.

On the token terminal chart, why is there no protocol revenue from the MVI related Index Coop or Set Protocol? They're turning in about $5k a day, as I understand.