This post is brought to you by…

NFTfi is a simple peer-to-peer marketplace for collateralized NFT loans. It allows borrowers to put up assets for a loan and lenders to make offers in exchange for interest. The NFT is held in escrow while the loan is active so lenders know for sure that they will either get their money back with interest or receive the NFT in exchange.

If you would like to borrow using an NFT for collateral, you can go to NFTfi and post your desired terms. If someone likes those terms, they can extend a loan to you. Alternatively, if you would like to provide a loan to individuals in exchange for favourable interest rates or the potential of scoring a specific NFT, you can do that too!

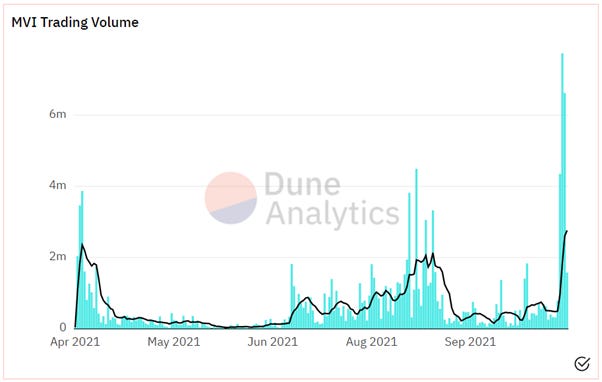

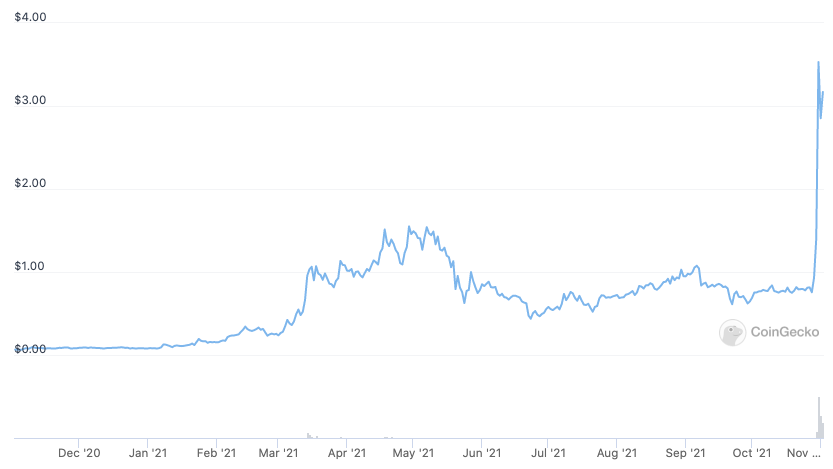

What a month for the metaverse and the Metaverse Index! And courtesy of Facebook, no less. On October 28th, Facebook officially changed its name to Meta, to make its focus on building the metaverse official and, perhaps, rebrand the company to move away from its tarnished image. We won’t spend too much time discussing the move. In short, Facebook is a centralised company, and we should be wary of their intentions for the metaverse, given their track record. At the same time, nearly 3 billion people now know that metaverse is a thing. That’s good. We saw an unprecedented amount of trading volume in MVI, almost $19 million in 3 days, with most metaverse tokens surging higher. Thanks, Zuck!

Looking at the numbers, MVI was up 112.3% in October, outperforming both BTC and ETH, up 40.2% and 42.4%, respectively. Since its inception in April, MVI returned 115.6% compared to 5.9% for BTC and 102.9% for ETH. That’s right, MVI has outperformed ETH since its inception.

Risk metrics remain largely unchanged, while net capture ratios have improved in October. MVI’s correlation to ETH and BTC is at 0.75 and 0.67 since inception. The same can be said about MVI’s beta to both, currently at 1.06 for ETH and 1.32 for BTC. We did see a meaningful improvement in net capture ratios as MVI outperformed during the month. Net capture for BTC remains healthy at 35.7%, while for ETH, this is the first time we are seeing a positive net capture ratio, at 8.7% as of the end of October.

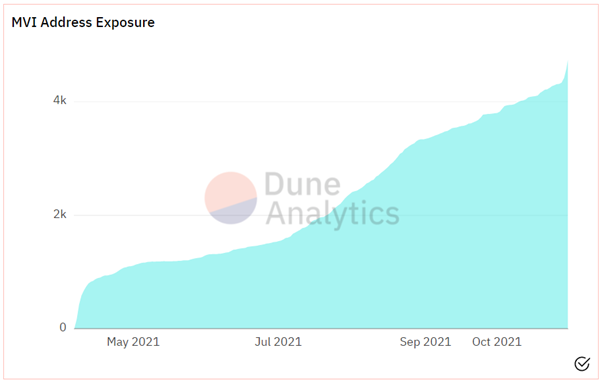

The growth in unit supply was fairly lacklustre for most of the month. However, we saw meaningful inflows over the last few days of October, leading to a 9% m-o-m growth in units. There were 181,360 units circulating at the end of the month. The number of unique addresses holding MVI rose 28%, hitting 4850. On an absolute basis, at 1,047 new addresses, October was our biggest month of unique user growth.

Overall, we are long-term bullish on the open metaverse. However, valuations for some projects are reaching meme-worthy levels. Most teams across the space will have to consistently deliver over the next few years in order to justify the current level of hype. Some will manage it, but most won’t. With money easy to come by, however, we might have more room to go before the reality sets in.

Portfolio performance

All the tokens in MVI were up in October, although NFTX and AUDIO only returned single digits. MANA was a standout, rising by over 300%, while SAND, ENJ, DG and ILV were all up over 95%. REVV and AXS were not far behind, rallying 71.8% and 85.2%, respectively.

The original virtual world built on a blockchain, Decentraland (DCL), saw its $MANA token rocket upwards in October, almost all of which came in the last few days of the month. This is no doubt directly due to Facebook’s rebrand to Meta. Large holders of MANA like Barry Silbert of Digital Currency Group took to Twitter to press home the narrative that Decentraland is building the decentralized and user-owned alternative to Meta’s virtual environment.

It likely helped that DCL had just concluded its very own ‘Metaverse Festival’ on October 24th, featuring Paris Hilton and Aluna George amongst others. This put the virtual world in the perfect position to capture the narrative, as always, a picture paints a thousand words...

The impact didn’t extend beyond token price, however, with marketplace volume fairly flat aside from a brief pump on the news. Fees (realised through the burning of MANA) totalled $250k for the month, barely double the $120k from April when we last reported on it. Given the 4x in token price, this is surely disappointing, and it remains to be seen if the speculation translates to new users for the virtual world.

SAND also had a nice run into the end of the month, rallying 134.1%. Facebook’s announcement clearly played a role here as well. The Sandbox is one of the older projects in the space with a public and reputable team and a vision for an open metaverse. It can also be best described as a virtual world, similar to Decentraland, and those types of projects caught a nice bid thanks to Facebook aka Meta.

The Sandbox team must be getting pretty close to the release of the Main Hub and ready to welcome metaverse denizens into its virtual world. The project is receiving 20,000 to 25,000 sign-ups each week and is on track to surpass 500,000 accounts total! And they keep delivering top-notch IP through partnerships with deadmau5, Walking Dead, Snoop Dogg and others.

Unsurprisingly, Enjin saw a similar pattern with their $ENJ token appreciating 50% in the last week of October alone. What Enjin is building differs from Decentraland and The Sandbox in that it’s designed to be an interoperable ecosystem for NFTs, as opposed to an explorable virtual world. Enjin joined forces with Decentraland in October however to announce the NFT Awards 2021, with the event itself being held in DCL.

The Enjin team delivered a number of updates last month centred around their NFT scaling solution called JumpNet. JumpNet is an Ethereum Virtual Machine compatible blockchain, offering fee-free transactions. The latest news covered how bridges between chains will be available by the end of Q4, allowing NFTs to move easily between Ethereum and JumpNet. Smart contracts are also due in the same timeframe, allowing anyone to deploy a contract on the sidechain using familiar tooling but of course, fee-free for end users. Kingdom Karnage (KK), a project using JumpNet, did a deep dive article explaining how Enjin’s solutions helped them scale if you’re interested in reading further.

Of particular interest in that article was just how much can be achieved by the addition of smart contracts. KK will use this upgrade to create their own token, unlocking governance, auction houses, trading and more. The fee-free nature of JumpNet does come with a caveat, however, as projects are limited to a certain number of transactions. In order to continue using the chain for free, users will need to stake EFI on JumpNet to increase the limits. It will be interesting to see how this model stacks up against alternative gaming-focused chains like Immutable and Ronin over time.

DG had a very good month, hitting a $500 million fully diluted valuation, with the token price up by 113.8%. If you have been reading MetaPortal, you’d know that DG was going to release its play-to-earn poker, powered by the ICE token and ICE wearables. The team sold 500 level 1 NFTs, generating $180,000 for the DG DAO Treasury. The wearables could be minted for 0.1 ETH and were spotted on the secondary market for nearly 12x a few days later. None were available for sale last time we checked, but don’t worry, the second mint is in the cards (pun intended) for mid-November. Why are these ICE NFTs so valuable? Well, you can use them to earn ICE tokens or, even better, delegate them to others and receive a share of the income they make. A pretty decent share too!

Lastly, Illuvium revealed their first gameplay trailer right at the end of October:

It was otherwise business as usual for the team with the usual cadence of releases and announcements. Highlights included:

Partnering with Warena to give cross-game integration for assets and resources.

Continued hiring, including marketing executives from Playstation and Riot Games.

A revenue share deal with Death Race.

All in all the token rose 99.1% during October as the team continues to knuckle down and work toward a Q1 release.

Closing Thoughts

We hosted a couple of podcasts in October, discussing intelligent NFTs (iNFTs) with Arif Khan, CEO and co-founder of Alethea.ai and chatting to cyberh49 from the Animetas NFT project. We also kicked off a new series of articles where we will attempt to take Matthew Ball’s “Metaverse Primer” and condense it for ease of consumption. Matthew’s essays are a must-read for anyone trying to understand the metaverse and we also want to further explore the idea of an open metaverse stack.

Last but not least, for this month rebalance, we are adding YGG to the Metaverse Index. The addition of YGG will give MVI holders some exposure to productive metaverse assets, like land and in-game assets, as well as pre-public investments in upcoming play-to-earn projects. We will soon be publishing a deep dive into Yield Guild Games, right here on MetaPortal, for those who want to learn more about YGG.

To learn more about the rebalance, check out our post on the Index Coop’s forum.

Thank you for the update! Has been another interesting month and, of course, Zuckerberg is going all meta.

Also, I noticed, Somnium Space looks the real meta-verse deal but wondered why its $CUBE is not in MVI?