Metaverse Index Monthly Update - September 2021

This post is brought to you by…

NFTfi is a simple peer-to-peer marketplace for collateralized NFT loans. It allows borrowers to put up assets for a loan and lenders to make offers in exchange for interest. The NFT is held in escrow while the loan is active so lenders know for sure that they will either get their money back with interest or receive the NFT in exchange.

If you would like to borrow using an NFT for collateral, you can go to NFTfi and post your desired terms. If someone likes those terms, they can extend a loan to you. Alternatively, if you would like to provide a loan to individuals in exchange for favorable interest rates or the potential of scoring a specific NFT, you can do that too!

After two months of solid performance, the Metaverse Index gave back some gains in September, underperforming ETH and BTC. MVI fell -21.7%, while ETH and BTC returned -0.9% and -7.3%, respectively. Since its inception in April, MVI is up 1.6% and continues to outperform BTC over that period while still lagging behind ETH. Despite a few projects in the index performing well, we saw investors’ interest shift from the Metaverse to NFTs, which was noticeable in the on-chain metrics for MVI and sentiment on CT.

There are not many changes on the performance and risk side. MVI’s correlation to ETH and BTC is largely unchanged from the previous month, sitting at 0.79 and 0.72 since inception. The same can be said about MVI’s beta to both, currently at 1.08 for ETH and 1.40 for BTC. Net capture ratios got a bit worse given the underperformance. However, net capture for BTC remains healthy at 28%, while for ETH, it’s still negative, sitting at -2.6%.

The growth in unit supply slowed considerably in September. After 33% in August and 36% in July, units grew just 2% this month. The number of unique addresses holding MVI rose 14%, sitting at just over 3,800, and has crossed 4,000 in October.

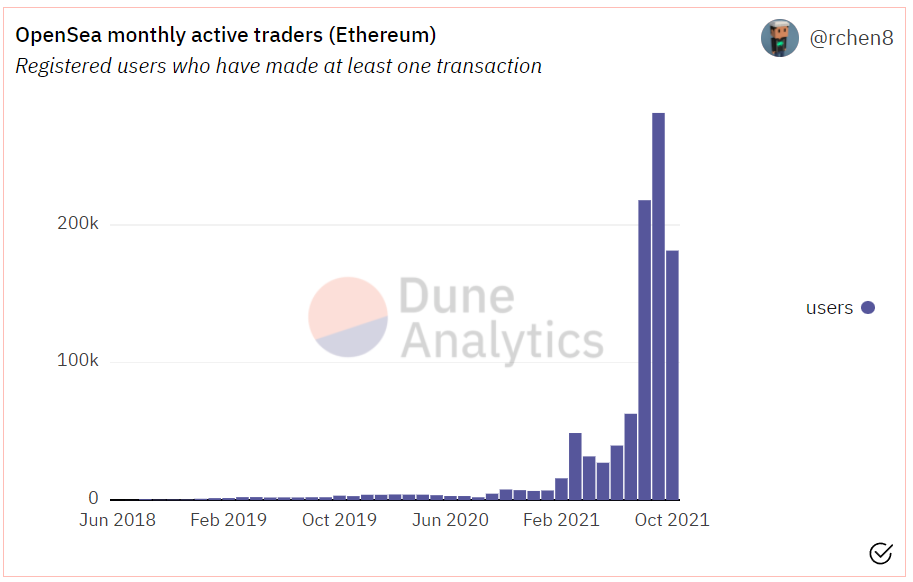

Overall, September was another huge month for NFTs, with OpenSea doing $3bn in volume, following $3.4bn in August. NFTs sold on the platform were ~3% higher m-o-m, and the number of monthly active traders was actually up over 30% and, by the looks of it, is about to grow even further in October.

We see a lot of low-quality and low effort pfp collections coming to market. There’s also a recent trend of NFT collections utilising DeFi primitives, like staking, to generate ERC-20 tokens. Tokens can then be used for breeding and other activities within an ecosystem. While experimentation is exciting and, in our opinion, pushes the space forward, we question the sustainability of it all at current levels.

Portfolio performance

Most of the tokens in MVI were down between 15% and 30% in September. AXS and ILV were the two exceptions holding their ground, up 2.7% and 1.6%, respectively. This was obviously before the AXS price rallied to $150 on the back of the staking launch and the latest funding round for Sky Mavis led by a16z.

Instead of commenting on the developments at each project, we wanted to take an opportunity to compare and contrast Axie Infinity and Illuvium. There’s undoubtedly some healthy competition between the two projects. However, we see them pursuing different goals and target markets, making some of the comparisons untenable.

Before we get into it, we want to highlight that there's a difference between Axie Infinity, the game, and Sky Mavis, the game developer behind Axie. Sky Mavis team has developed several products, including Axie Infinity and the Ronin sidechain, and is getting ready to launch the Ronin Decentralised Exchange (DEX) later this month. So when we talk about the Axie Infinity ecosystem, we mean all of these products.

So let's dig in. We saw ILV run-up over 40% following the recent announcements from Sky Mavis and, more or less, no project-specific news. We believe that many see Illuvium as the next big thing in blockchain gaming. Therefore, significant successes for the Axie Infinity ecosystem get extrapolated to Illuvium. At the same time, we think that these two projects are very different. Their only similarity is that they use play-to-earn economic design. We could also say that they both focus on gaming, but while that's 100% true for Illuvium, we are not sure that's actually the case for Sky Mavis. Why would a gaming project build a sidechain? Or a DEX, for that matter? We see Sky Mavis building a powerful economic engine, primarily for emerging markets, extending way beyond gaming. Perhaps they started with a game, but their ecosystem will provide valuable financial infrastructure to many worldwide. So are Illuvium and Sky Mavis competitors at all? Not really. Axie Infinity and Illuvium are, as both are games, but Sky Mavis and Illuvium are not, in our opinion.

For example, if we look at Axie Infinity, the game, it's clear that it's not the best. When Kieran says it's not fun, he’s right if you are looking at it from the perspective of a AAA quality game. But is Sky Mavis trying to build a blockbuster video game with Axie? Not at all. They are trying to create the financial infrastructure and a play-to-earn ecosystem for the developing world. Playing Axie to earn and using Ronin as your bank account doesn't need to be as fun as playing CS, Fortnite or GTA. As a vehicle for generating income, the game is 10x more fun than driving a taxi or doing manual labour. And using Ronin as a bank account is also a 10x improvement on often non-existing financial infrastructure in some of these countries. Ronin DEX, when it launches, will make it very easy for any Axie player to swap SLP into USDC. Given persistent inflation in the local currencies across many emerging markets, this would offer an invaluable service for the Axie demographic. Perhaps we will see a borrowing and lending service on Ronin in 2022, enabling yet another financial primitive. All underpinned by over 2 million DAUs, and growing, that come from the game.

But wait, can't Illuvium do this while also offering a fantastic, engaging, and truly fun game? In our opinion, they can't, and we are not sure they are trying to. The play-to-earn claims when it comes to Illuvium are secondary. The team and the community are focused on building AAA-quality video games using the Unreal engine. I can't wait to play it. But the main game is desktop-based, which is a necessity given the graphics but makes it not accessible to swaths of people across the emerging markets. Illuvium says the game is free-to-play, but it's not that different from Axie Infinity if you have to spend $600 on the computer.

Hold up, isn't Illuvium's land game being developed for mobile? Yes, it is. But while it is play-to-earn, it's not free-to-play. Not only do you need to buy the land itself, but you also need to buy buildings to generate an income from it.

Edit: there will be a free-to-play version of the mobile game but it will not have any play-to-earn mechanics.

So from our perspective, comparing the Axie Infinity game and Illuvium like for like is misleading. The game is only a part of the Axie Infinity ecosystem, while for Illuvium, it is the ecosystem. No one, for example, is criticising Illuvium for not building their own sidechain. This is something we want our readers to keep in mind when they read complaints about Axie’s game quality or the sustainability of its in-game economy.

That said, we do want to address the criticism around the sustainability of Axie's economy if the SLP price stagnates or falls further.

SLP is a crucial component of the Axie economy. At the moment, it's actually the only financial incentive to attract new players. Perhaps the seasons with AXS rewards for top players is another incentive, but it's variable, while SLP rewards are daily and constant, i.e. players know they will be able to earn on a day-to-day basis. The argument goes that if SLP prices are low, new players are not sufficiently incentivised, and player growth stagnates. That's what we have seen over the last couple of months, with DAU growth moderating from 30%-40% w-o-w to mid-single digits. As player growth stagnates, there's less demand for new Axies, which results in less breeding. Breeding requires SLP, so less breeding leads to a drop in the demand for SLP. Less demand means, all else constant, lower price. As you can see, there's a vicious cycle here that can, theoretically, lead to the collapse of the economy.

Now, this loop should be obvious to anyone who follows Axie Infinity. Currently, the main lever the Sky Mavis team can pull to manage the SLP price is the breeding cost. By adjusting the amount of SLP needed to breed an Axie, the team can influence the demand for the SLP token. They did cut the total SLP available for in-game rewards in half a few months ago to reduce emissions, but it's hard to see the team using this lever too often, if again.

We believe that the upcoming releases of the Ronin DEX and the Axie Infinity: Origin battles upgrade should be sufficient to attract new players and stabilise the SLP price at a higher level. It won't surprise us if the breeding costs are adjusted again, eliminating the AXS requirement altogether while increasing the amount of SLP needed for breeding. Is this particular mechanism sustainable for the long term? Probably not. But, in our view, it doesn't have to be. As we mentioned above, SLP serves as the onboarding vehicle and currently has limited utility in the ecosystem, i.e. only used for breeding. Its importance can be reduced by using other methods to reward the players and improve play-to-earn sustainability. For instance, the AXS token is supposed to have around 20% inflation over the next couple of years. The early draft of the token economics showed a large share of that going to players, although we are unsure if the team's thinking evolved since then. So we expect more tournaments, battles, rewards, guild games, etc. Another approach would be to add additional utility to SLP, which would make the demand/supply equation more balanced. Here, we can see the potential for leveling up Axies using SLP, crafting items for the land game, etc. Needless to say that we see SLP as a solvable problem that will be addressed by the team through a combination of different measures on the supply and demand side. With the recent funding round in the books and a solid track record of execution, we have a lot of confidence in the team.

To wrap this up, we are incredibly excited about both Illuvium and Axie Infinity. We can't wait to play Illuvium when the game is released in 2022, and we are looking forward to the expansion of the Axie ecosystem. However, these projects have different priorities and target demographics, with the only similarity being that both heavily utilise play-to-earn mechanics in their ecosystems. As such, comparing them like for like is misleading and ignores a whole lot of context.

Closing Thoughts

We put out no written content in September. Still, we did go heavy on the podcast side, interviewing Jiho from Sky Mavis, Nick Tomaino from venture fund 1confirmation, and Andrew Steinwold, known for his Zima Red podcast and investment firm, Sfermion.

We spoke a fair amount about Illuvium above. If the project piqued your interest, check out our deep dive as well as our podcast conversation with Illuvium's co-founder, Kieran.

Last week, we successfully rebalanced MVI in line with the methodology. There were no additions during the month. However, we did remove MUSE due to consistently low market capitalisation. We also slightly changed the inclusion criteria for the index, increasing the market capitalisation threshold from $30m to $50m.