The Metaverse Index 101

Get liquidity for your NFT now via NIFTEX

Build new communities around your NFTs/Land and unlock liquid NFT markets with NIFTEX fractionalization. Try it out here!

Since we launched the Metaverse Index ($MVI) on April 7th, we have published a few articles about it and were featured in the Metaversal, Yahoo Finance, and Blockbeats in China. However, it recently occurred to us that 3 months in, we have much more data and context we can share with the community.

This article is meant to be an all-inclusive primer on the Metaverse Index, what it represents, the macro, progress to date, and much more.

Let's dig in.

What is the Metaverse Index?

Before we get into this, it might be worth clarifying the definition of the Metaverse. We wrote about it here and would encourage everyone to give it a read for some context.

Here is a simplified definition from Enjin, one of the projects in the MVI. In their words:

The "metaverse" is a shared digital space that seamlessly integrates aspects of the real world — specifically things like ownership, identity, and financial value.

The Metaverse Index then is a simple way to invest in the emergence of this digital space. As @darkforestcap likes to put it, the Metaverse will become essentially indistinguishable from reality over the next decade, powered by blockchain, virtual reality, haptics, etc.

From the product perspective, MVI is an ERC-20 token that provides its holders with exposure to projects that are building the Metaverse. We use various quantitative and qualitative screens to select tokens for the index, as outlined in the methodology. Overall, MVI offers many benefits, including diversified exposure to the sector, eliminating the necessity to research individual tokens and projects, and significantly reducing the cost (financial and time) to allocate to the Metaverse.

Metaverse as an Investment

So why would you want to invest in the Metaverse theme in the first place?

At the most basic level, you can think of the Metaverse as the global economy 2.0. We already have a global permissionless settlement layer, some medium of exchange and store of value assets, and an entirely new financial system. We are getting close to a genuinely decentralised stablecoin not tied to the US dollar. We have authentic digital ownership through NFTs, and soon, we will have an on-chain identity attached to an Ethereum address, not an individual.

These are just some of the building blocks that will eventually turn the Metaverse into the largest global economy. Wouldn't you want to own a part of that?

There are, obviously, plenty of technical challenges that need to be addressed for the Metaverse to be truly persistent and integrated throughout our lives. We recommend reading Matthew Ball's Metaverse Primer for more context. At the same time, there are also many tailwinds, from demographic and societal to environmental, making Metaverse inevitable.

COVID showed us that remote work is the future and remote work is, by definition, digital work. Traditional hierarchies don't fit too well in the current environment, and now that everyone knows they can work remotely, taking on projects here and there, no one will care too much for going back to the industrial age way of working. Demographics are changing as well, and we explore how this plays into the future of work narrative here.

On the environmental side, the physical world is becoming less hospitable – a trend that will only get worse. And if the real world is getting worse, many will opt for the digital world that can be designed to specs. Further, we are running out of physical space, with a large portion of the world being overpopulated and running out of scarce resources. But where physical space is limited, digital space is infinite.

And lastly, on the economic side, software is eating the world, facilitating disruption of every industry. Blockchain projects are software but powered by decentralised, global communities. The economics of blockchain businesses and protocols are superior to their traditional counterparts, meaning we will see protocols and DAOs proliferate and combine into economic powerhouses.

For those who choose to allocate to this investment thesis, there are a couple of options. You can invest in:

Individual tokens.

Digital real estate.

Individual NFTs.

Indices and other products (NFTX vaults) that enable macro bets.

Each option has its pros and cons, which investors should consider in their decision-making.

Our Experience To Date

We have learned a great many things during the first three months of managing MVI. Let's start with a quick assessment of the market. Based on our data, we believe there's meaningful demand for a passive product that captures the Metaverse thematic. To date, that demand has come primarily from small holders and retail investors (when looking at the number of addresses, not AUM). Those holding less than 50 units of MVI or roughly $2,500 make up almost 82% of total addresses but only 15% of total AUM. This is partially due to low MVI liquidity on Uniswap. However, the recent rise of Axie Infinity has created a compelling narrative around the Metaverse, bringing in more investors. We have seen addresses holding more than 250 units increase significantly in July. We will do more work to understand if there's meaningful demand for this product among whales and how we can tap into that demand.

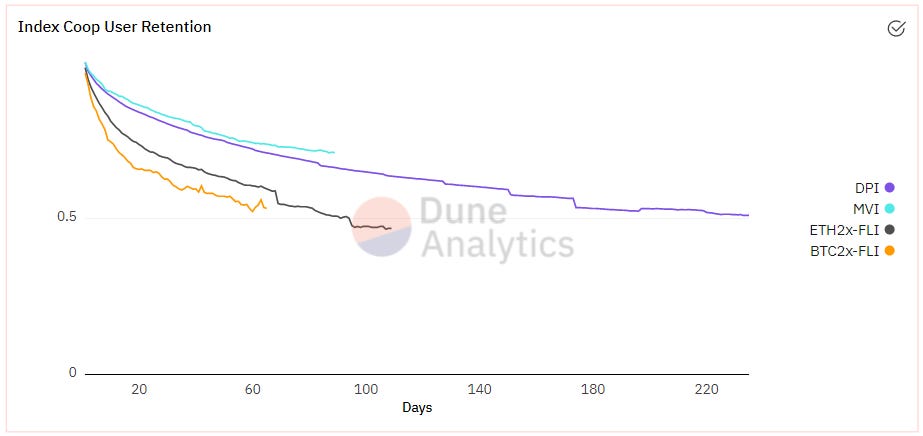

Another way we are thinking about product-market fit is based on data points such as retention rate and unincentivised unit supply. Three months in, we see over 70% retention rates across cohorts. In fact, MVI has the highest retention rate among all our products.

Furthermore, unincentivised units increased from 35% to 71%. This tells us that not only are our customers holding the product but that they are also not here for the $INDEX rewards from liquidity mining. Overall, it appears that there's significant demand for simple, passive exposure to the Metaverse narrative.

One of the challenges of capturing that demand and growing MVI is the low DEX liquidity in some of the underlying tokens. This has certainly factored into our thinking around liquidity mining incentives and how we think about growing the product. The truth is that relative to DeFi, most Metaverse projects are a fair bit behind in terms of token economic design and attention to the liquidity of their token. With added complexity from sidechain and L2 migrations, managing MVI growth against this backdrop has been challenging. However, we hope Uniswap V3 will help alleviate some of these concerns once teams are comfortable using Uniswap's V3 contracts for liquidity mining incentives.

These learnings all play into our roadmap. If people are holding passively, can we create some utility for MVI that doesn't require liquidity provisioning? If MVI liquidity is insufficient to support large purchases, can we incentivise them directly? And, of course, how does Uniswap V3 affect us?

How to Get Some MVI?

Alright, let's say we did a great job with this article, convincing you to buy some MVI. How should you go about it?

There are two main options.

Buy existing units.

Create new units.

In terms of buying, our main pool is on Uniswap V2. However, there's also a small V3 pool, and we are working on having MVI liquidity on Polygon as well.

When it comes to creating new units, you can either mint by depositing the underlying tokens in the correct proportions into the smart contract or use our exchange issuance functionality. Instead of having the right amount of each of the underlying tokens, exchange issuance acquires those tokens for you and mints new units of MVI. If you have questions about any of these options, please hop into our Discord or DM us on Twitter, Discord, TG, etc.

Summary

To sum it all up, the first 3 months of MVI's life have been a whirlwind. Despite challenging performance, we remain incredibly bullish on the Metaverse theme. The great societal migration to the digital space will eventually create a global economy 2.0 in the Metaverse. It will run on top of Ethereum and be plugged into DeFi. We have barely started on this journey.

On MVI, specifically, we see encouraging signs of product-market fit and believe that some of the challenges around liquidity should be addressed over time. There are certainly some things we can look at with the methodology to limit the impact. More to come on this.

Overall, the Metaverse is inevitable. We encourage everyone to consider allocating some capital to this theme, whether through a passive index like MVI or through other means we mentioned above. This is, obviously, not financial advice. Please do your own due diligence before investing in crypto.