In our recent research piece on value accrual in play to earn economies, we analyzed value accrual per capita as a core monetization KPI. In the process, we found some interesting data on the Axie economy which gave us:

A new perspective on the soft-currency rewards in crypto gaming economies

New metrics that can be tracked across other projects (provided appropriate data disclosure from teams)

Further conviction around sustainability and the necessity of the development of new economic models

Methodology

This analysis looks at a few crucial data points on the Axie economy. First is the value accrual to the Treasury, in the form of ETH from marketplace fees and AXS from breeding. Next is the net SLP mint rate. And, finally, daily active users (DAUs). Sky Mavis discloses weekly value accrual in this spreadsheet as well as DAUs. For the history of SLP transactions and therefore the net SLP mint rate we ran a Ronin node. We used weekly average prices for ETH, AXS and SLP, calculated by averaging daily prices for a given week. Prices were sourced from CoinGecko. Here’s the data file for anyone looking to review and / or verify.

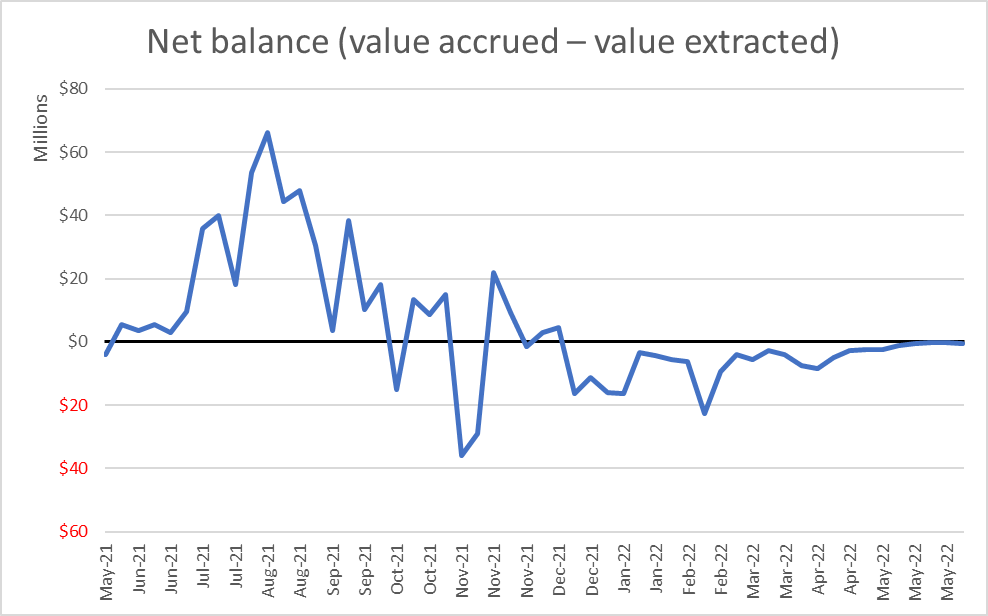

Specifically, we looked at the $ denominated inflow to the Treasury vs. $ denominated net SLP minted, assuming different percentages of the net SLP minted were immediately sold. This allowed us to track value accrual to the Treasury vs. amount of incentives paid to players to accrue that value or, alternatively, the $ amount that was extracted from the economy by the players, including guilds. Furthermore, we looked at the net balance (value accrued – value extracted) on a per player basis and the ratio of value accrued to value extracted.

The Data

This chart assumes that 75% of all net SLP is sold. It shows that every week (barring one), starting from end of September 2021 and until today, more value has been taken out of the economy than accrued to the Treasury. We will talk about our conclusions later.

Similar to the previous chart, this one assumes 50% of all net SLP is sold. It presents a more balanced picture, with the situation deteriorating in the middle of December and not late September in the 75% scenario. It is our assumption that the truth lies somewhere in between 50% and 75% of SLP being sold, given the nature of the player base, however it wouldn’t surprise us if the number was above 75%. The SLP numbers are net, meaning that the SLP burn is already incorporated.

If we convert the 50% scenario into a ratio, we get the following chart. Here, a negative value would indicate a weekly net burn of SLP and anything between 0 and 1 indicates that a weekly net mint of SLP is below the weekly amount in ETH and AXS brought into the Treasury. We can see the deterioration here as well, starting from mid-December, with the ratio never getting anywhere close to 1 since. The negative number in early January appears to be a fluke with Axie reporting a negative change in the Treasury balance.

We can also look at the net balance per player, using the DAUs number provided by Sky Mavis. In our analysis of value accrual per capita we focused specifically on this metric as an indicator of monetisation. However, taking into account the value taken out of the economy by the players we get a somewhat different picture. In fact, we’ve seen the economy shift towards decline and extraction from late September to early October, despite a variety of measures taken by Sky Mavis.

Some Thoughts on the Data

First and foremost, let’s look at the SLP spend as incentives instead of a permanent so-called play to earn mechanism. How does the SLP incentive campaign compare to your garden variety DeFi incentive campaign?

In DeFi, incentives are usually paid out in a governance token, leading to inflation and sell pressure, and capital acquired via incentives, whether liquidity or TVL, tends to be mercenary and leave as soon as incentives run out. Compare that to the SLP incentive campaign. Rewards are paid out in an inflationary token with limited use and no connection to governance, they don’t create inflation or sell pressure on AXS and can be minted at will by the protocol. What does that protocol get in exchange? You might think that the goal of the SLP incentive campaign was to attract DAUs. That’s partially correct, but we believe that the actual goal, whether on purpose or not, was to attract economic activity, namely marketplace trading and breeding.

Let’s look at the results. From 31 May 2021 to 6 June 2022, Axie Treasury accumulated around $1.36bn in ETH and AXS from economic activity. Assuming 75% of net SLP being sold, they paid out $1.64bn in SLP incentives to players. If we use 50% of net SLP sold, we get about $1.1bn in SLP incentives. These numbers are pretty impressive, considering that Axie effectively exchanged between $1.1bn and $1.64bn in SLP for $1.3bn in ETH and AXS, while still retaining close to 600k DAUs.

What can we learn from this?

Soft currency, if considered as an incentive, can bootstrap both treasury and player liquidity. However, a lot depends on a team’s decision regarding the denomination of their marketplace and other value accrual mechanisms. Denominating the marketplace in the soft currency or even the governance token makes little sense if a team wants to bootstrap the treasury.

Teams should monitor treasury value accrual vs. value extraction by players. A mismatch here can indicate a need to re-examine the incentive mechanism or potentially consider other options to limit value extraction.

Teams should monitor value accrual – value extraction on a per player basis, which might tell a different story from #2 above.

Teams should prepare for a scenario where value extraction becomes a significant drain on the economy. Various population control and value retention mechanisms can be deployed in this scenario.

We would also argue that in dual token economies, the soft currency should be used as an incentive mechanism. It therefore makes little sense for projects to allocate a significant share of the governance token, 30% is common today, for play to earn rewards. That allocation could instead be used to reward contribution to the ecosystem and skilled gameplay, while the soft currency should reward participation in a more balanced manner.

A Call to Action

If you are a crypto gaming studio or project and want to talk to us about your in-game economy, we’d love to hear from you.

MetaPortal DAO is looking for contributors to help drive sustainable value accrual and active governance in crypto games and metaverse ecosystems. If that’s you, send us a DM.