At MetaPortal DAO, our mission is to assist crypto games in designing economies that accrue value. To achieve this, it is important to first understand whether/how gaming economies are accruing value today. We can then analyze existing models, learn what works, and work on how they can be improved going forward.

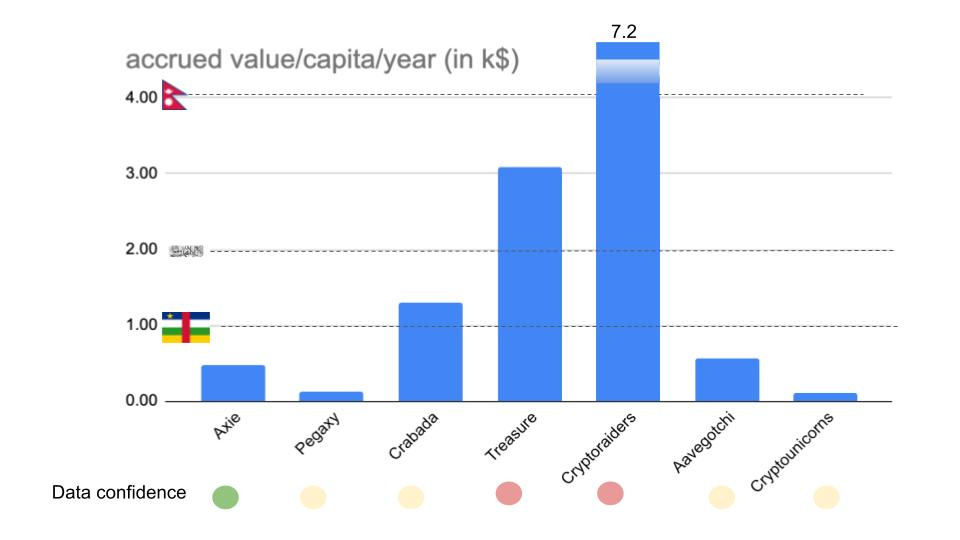

As the first step in our research into value accrual for crypto game economies, we have put together a comprehensive data-driven analysis of value accrual mechanisms and their total and month-to-month efficacy for six gaming economies. We report a value accrual per capita (unique NFT holders) for each game, which we believe is a core indicator for community activation and economic participation.

Table of Contents

Our methodology

The data and notes on the data

Some lessons learned

Additional general thoughts on value accrual and reporting

Conclusions

Methodology

Treasury and Value Inflows

We examined 6 crypto games with the criteria that they have:

A live treasury

Recurring value inflows from ecosystem activities to the treasury

The most common value inflow activities we documented were:

Marketplace fees - royalties or taxes on secondary market sales

Recurring primary sales

Breeding fees

Renting fees

We tried, where we could, to adjust for non-recurring value flows including

Land sales and other one-off primary sales (this can be somewhat subjective)

Token transfers from other team, ecosystem accounts

Other out-of-ecosystem, non-core game loop value accrual mechanisms

For monthly value inflow figures in USD, we took the monthly average token price and multiplied it by the difference between last month’s and current month’s treasury token balance. The same methodology has been applied to breeding or marketplace wallets, when those were separate from the main treasury multi-sig.

For total value accrual figures (figure #1) we used the current token price as of 6/1/2022 multiplied with the total tokens in the treasury.

Unique NFT Holders and DAU (The Per Capita Part)

As a proxy for DAU we looked at unique NFT holders. Note, there are large discrepancies between DAU and NFT holders especially for Crabada and Axie. However, we have chosen this metric for the sake of normalization across games and chains.

DAUs are largely off-chain metrics that are not widely reported by studios. If you’re a crypto game indexed on our current dashboard, or a game with an active in-game economy, value flow to the treasury, and would be open to sharing DAU figures we’d love to chat.

Arriving at Value Accrual per Capita

Finally, we divided total and month to month value accrual to the treasury in USD by unique NFT holders, and new unique NFT holders. This allows us to arrive at figure 1 and figure 4.

In crypto game economies where controlling key infrastructure and encouraging economic activity is the main source of revenue, we believe this is a core monetization KPI. We hypothesize that a value accrual per capita in the absence of player base growth, indicates a strong community activation, and a strong economic participation of players.

The Data

See the full spreadsheet here

Chart 1 (Figure 1) shows annualized value accrual per capita for each of the 6 game economies we looked at. Some remarks on data confidence:

DAU / Unique NFT holders for Axie is 27%. Since all-time-high, DAUs are down 75%, while NFT holders are only down 18%. Unique NFT holders as a proxy for DAU held well for the first 9 months but has diverged since Jan 2022.

Crabada has moved to the Swimmer Network which is significantly harder to index at the moment. The high value accrual / capita is a result of a low unique NFT holder count. For instance 92% of all Crabadas are held by 0xd938879f18ffe23b3622c5804421f73001d94672 which we hypothesize is the Avax -> Swimmer NFT bridge account. Crabada’s DAU count is also reportedly 5-6x that of its unique NFT holder count.

For Treasure, we only have access to the “DAO Marketplace Multi-sig”. It is unclear if all MAGIC inbounds to this address are considered recurring value accrual. There was also 1.8M of MAGIC removed in April which we have normalized for reporting purposes. There are potentially other wallets and mechanisms that accrue value that we may have missed.

The CryptoRaiders treasury address is currently not accruing value and is depleting AURUM over time. At this time, we are not able to capture the LP fees the project is generating from protocol owned liquidity. It’s also not clear to us if any in-game AURUM spend is burned and how we can track off-chain AURUM transactions, like purchases of key or scrolls. We hope to resolve these issues over time. (S/o to the amazing Raider dashboard for helping us figure things out.) We have also elected to ignore the raw crafting materials deposited into the treasury as per guidance from the core team.

Aavegotchi figures don’t account for the 1% Baazaar (marketplace) fees.

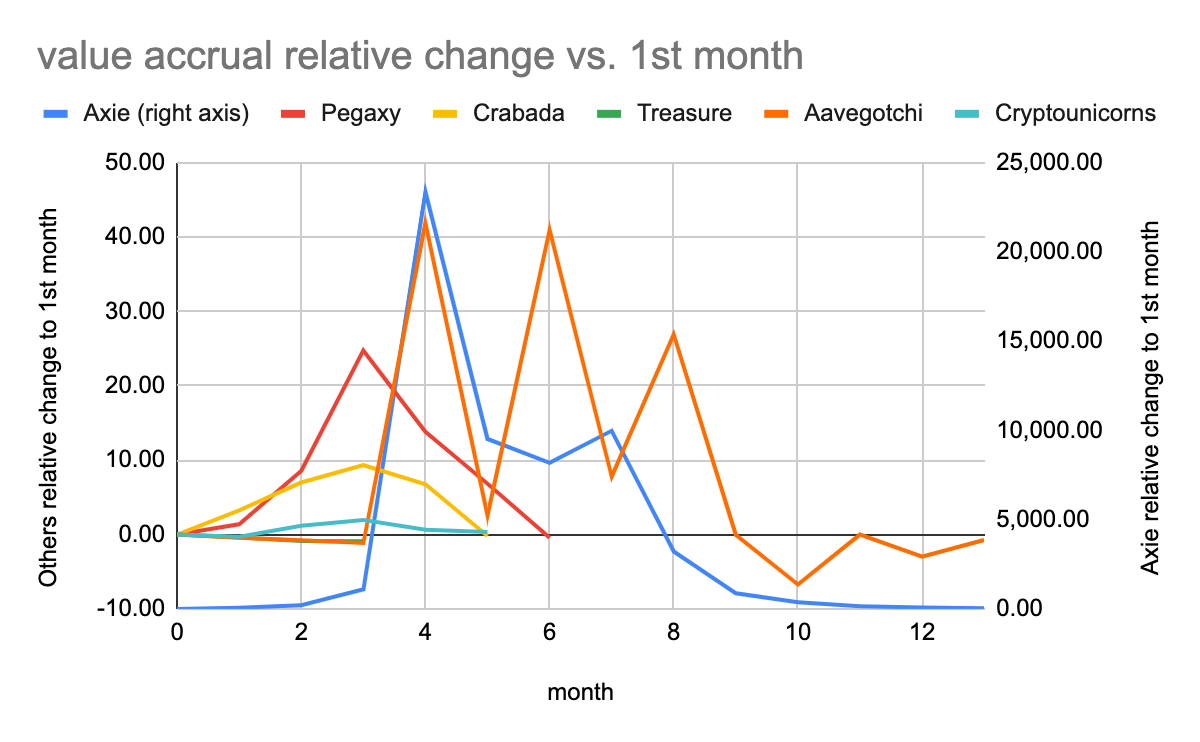

Chart 2 shows:

Crypto games that grew extremely fast initially are slowing down their growth trajectory. We hypothesize that a slight positive correlation between how early the game was released and how long it lasts without user growth stagnation.

We likely have a data confidence issue with Crypto Unicorns.

Despite having consistent growth since launch, Aavegotchi is also experiencing stagnated growth in the semi-bear market.

Chart 3 notes:

Our omission of CryptoRaiders is not a mistake. The CryptoRaiders treasury is often utilized and value sent elsewhere, hence it was difficult to track and normalize this data to present a month to month figure.

Chart 4 shows Axie month to month delta in value accrual divided by month to month delta in unique NFT holders plotted against value accrual/capita and total holders.

Value accrual delta / population delta refers to the change in value accrual for the marginal change in new unique NFT holders. As you can see the month to month values are steadily declining, pointing to the fact that new Axie NFT holders contribute less and less to value accrual in dollar terms. This doesn’t necessarily mean that they are less active economically as value accrual is subject to fluctuations in token prices.

During August-September, when Axie was experiencing exponential growth, we see that the marginal NFT holder increased value accrual, resulting in a large spike in total value accrual / capita. Note that this was also during the period of explosive growth in AXS value.

We’d ideally love to collect this data for all game economies. Here is the reporting standard set by Axie.

General Observations About the Data

It’s worth noting that we have been in a down trending market since the beginning of the year. Prices of every soft currency token have collapsed, which could be attributed to poor general market conditions not necessarily bad economic design.

As we’ve seen with Chart 3, regardless of large initial population growth (Axie, Pegaxy) or slow population growth (Aavegotchi, Crabada) most game economies are failing to have sustainable value accrual. We believe this might be further exacerbated in the absence of value retention mechanisms (sinks).

For most crypto gaming economies, players tend to extract value through farming the soft currency / utility token (the SLP, VIS, TUS). In early stages, when population size is low, value extraction is attractive. This leads to rapid population growth and a meaningful increase in economic activity which accrues value to the treasury. Value accrual usually comes in the form of hard currency (ETH, AXS, PGX, etc.). Eventually though, new player growth is not sufficient to perpetuate the cycle leading to a collapse of the soft currency. With it, economic activity dries up and marginal treasury value accrual diminishes with it.

This poses a difficult problem - how do you have players continue to participate in the economic loop that accrues value to the Treasury? As a game, you must maintain players’ ability to extract value at a sufficiently high USD level while growing DAUs (which is likely impossible) or see sustained economic participation despite a fall in the value of the utility token to continue to accrue value to the treasury.

There is a clear need to have value retention mechanisms, as per point 2, to encourage NFT holders to continue to participate in the economy over time. A sign of a healthy economy is NFT holders = DAU. When NFT holders >> DAUs, game economies begin to resemble real life aging economies, with no active participants to generate productive economic activity and accrue value to the core token.

Overall, the design space to develop tools to effectively manage both population growth and value extraction is just developing. We hope to do more work on this in the future.

What We’ve Learned About the Space

It’s been quite obvious from this exercise that very few metaverse economies are actually accruing value to their core token. We looked at dozens of games yet only found 6 that:

Had live value accrual mechanisms and,

Were transparent enough to study.

Many games cited the existence of a treasury and value flows, but did not have transparent enough or accessible enough data reporting (contract addresses, multi-sigs…etc) for us to gather this data. We believe this is a dangerous practice, as community members have a right to know where value is flowing into, who controls it, and what it's being used for. To this end, we have put together a comprehensive reporting guideline that we believe will provide minimal overhead to gaming economies, while still greatly amplifying transparency.

Treasury

We marked in black what we believe should be reported.

In addition, we believe reporting all NFT addresses and operational contract addresses (breeding, marketplace, bridges) for every chain is a great practice. See Crabada, Axie for some great examples.

Furthermore, we want to open source the list of contracts we’ve collected and invite anyone from the community as well as game studios to add to it.

Further Research Topics

We are at the beginning of the development of crypto gaming economies. We believe that there is an large design space in terms of improving value accrual loops to increase value accrual / capita in the long term (i.e. without being short term extractive). With time, MetaPortal will advance the art of value accrual to governance token holders, active participants and contributors to a crypto-game ecosystem.

Some further research topics:

Difference-in-differences analysis to see why some economies value accrue, activate community better than others

Additional economies policies to prolong health of the economy, economic participation of NFT holders

Experiments in governance and revenue distribution to high value participants in the ecosystem to unlock value accrual flywheels

A Call to Action

MetaPortal DAO is looking for contributors to help drive sustainable value accrual and active governance in crypto games and metaverse ecosystems. If you are

Anyone interested in solving community governance at scale, value accrual in complex virtual economies

Mechanism designers

Data scientists

Game economists

Game historians

Community coordinators

Discord mod (lol)

Any general loveable nerds who have been playing games for the last 20 years and want to help build the future of crypto gaming

We’d love to hear from you.

Apply here to express interest in contributing to this DAO.

In the meantime, jump into our Discord.

Disclaimer: Nothing in this article is intended to provide financial advice.

Great article! Value accrual is a good measure of value inflows to the game platform (hence the governance token), although for the entire game economy, I think a good measure would be simply new cashflow into the game.

Also, I think it's important to distinguish, if possible, value accrual by spending purposes - 1) for fun vs. 2) for economic gains. I know that there isn't a fine line between 1), and 2), as often the two purposes are mixed. Perhaps a spending that isn't immediately tradable & does not provide continuous income stream would be classified as spending for pure fun.

The methodology may vary but it would be easy to understand that value accrued for 1) is far superior than value accrued for 2), as the latter would eventually end in value outflow. 1) would mean the value would either be sustained for a while before leaving the system and may not result in outflow at all.

A good example would be the slower decline of Axie Infinity versus Pegaxy, where the lack of gaming element in Pegaxy makes spending in the game purely for financial gains. When the financial incentives diminish (which happens new entrants slow down), the money leaves the economy quickly. There is an element of fun in playing Axie, which makes exiting the game economy more reluctant, but I'm not sure there's strong enough fun to maintain a big enough economy. Plus, the large value accruals were spent mostly by guilds, which are made with the purposes of making financial gains.