Get liquidity for your NFT now via NIFTEX

Build new communities around your NFTs/Land and unlock liquid NFT markets with NIFTEX fractionalization. Try it out here!

July turned out to be the Renaissance month for the Metaverse and NFTs. We have seen significant price appreciation across tokens, individual NFTs, and entire collections. The Metaverse Index, MVI, returned 102.6% in July, outperforming both ETH and BTC, which returned 11.5% and 18.7%, respectively. MVI has now outperformed BTC by about 9% since its inception in April while still underperforming ETH by nearly 40%.

Looking at the performance and risk data, MVI’s correlation to ETH and BTC has come down a bit this month, bringing since inception numbers to 0.78 and 0.70. At the same time, MVI’s beta to both increased from last month, now sitting at 1.1 for ETH and 1.41 for BTC. Downside and upside capture ratios also improved, which is not surprising given the strong performance in July. Since its inception, MVI captured 161.6% of BTC’s upside and 131.9% of its downside. It’s certainly encouraging to see the net capture ratio for BTC turn positive. As for ETH, upside capture is at 107.9%, up from 83.3% at the end of June, and downside capture is at 115.8%, down from 121.5%.

MVI stats

With some of the high-level performance data out of the way, let’s take a look at non-performance stats for MVI.

After growing by 15% in June, MVI unit supply increased by 36% or roughly 33,000 units in July. In the first nine days of August, we saw an additional 15,600 net new units created, 12.6% MTD growth. We are certainly encouraged by these numbers and believe that MVI is becoming an easy way for many to play the Metaverse narrative.

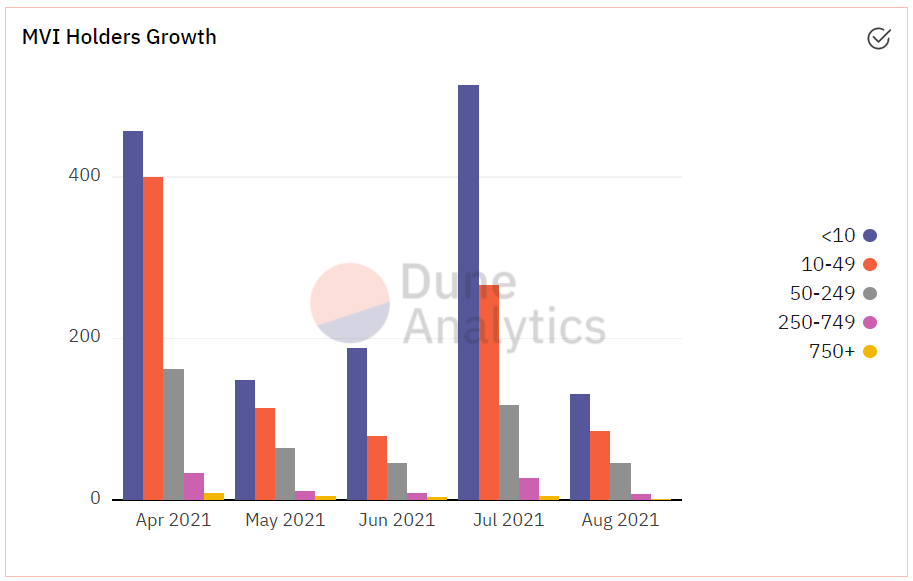

Alongside the growth of unit supply, we also saw a significant increase in the number of addresses holding MVI. New addresses grew by 54% in July and are up another 9% so far in August. Total holders are now at over 2500. This growth came primarily from smaller holders, specifically those holding less than 50 units. August has been a bit more balanced to date.

Retention rates remain strong. The June cohort is still sitting pretty close to 90% retention, while the July cohort has the lowest retention rate so far at 79% 36 days in. This makes sense given the significant price rally, and we surely can’t blame anyone for taking profits.

Portfolio performance

July is the first month since the inception of MVI, where the majority of tokens delivered positive returns. Overall, performance was driven by the 650% appreciation in the AXS token and 165% return for SAND. NFTX, REVV, TVK and MUSE also contributed, returning 223%, 172%, 133% and 98%, respectively. And even though the Metaverse was hot in July, some tokens still managed to buck the trend and register negative returns. RFOX, MEME and RARI all underperformed, returning around -17% in July.

We write about AXS literally every month as the token continues to outperform. Just recently, Axie Infinity hit 1 million Daily Active Users (DAUs), a significant milestone in the game's development. The team has also tweaked some economic parameters, which might lead to changes in user behaviour. There are also whisperings of a pretty substantial capital raise as Sky Mavis looks to onboard many more millions of users, develop its land gameplay, and continue building out the Ronin ecosystem.

NFTX was another token that appeared to benefit from the market euphoria around NFTs, while also delivering a significant product update to press home the advantage. The token returned 223% during July.

Throughout the month, the project saw a drop in V1 vault usage as migration to the newly deployed V2 vaults took place. This movement of liquidity was designed to occur passively, but the team stepped things up a notch midway through the month with the announcement of staking rewards. With this upgrade, all V2 vaults now offer the ability for liquidity providers to earn 100% of minting fees by staking their vault token with ETH on Sushiswap. 677% APR on your Avastars anyone?

The chart above shows the progression of users switching to V2 vaults. The same trend is apparent in the number of active vaults, which grew from 27 to 75 (277%) in July alone, tied to the proliferation of new NFT projects. More mint/redeems = more fees, and with the staking rewards live, this resulted in rapid growth for value locked in vaults and yields for liquidity providers, creating a reflexive loop. In summary, the excitement around the changes at NFTX and top NFT projects more generally seems to have set the stage for the token's massive run during July.

One of the less frequently mentioned tokens in the MVI, REVV (representing F1 Delta Time and MotoGP ignition), had its best month so far, up 172%. Performance seems to have been driven by two themes. Firstly the meteoric rebound for NFT markets during the latter half of July. Secondly, more details coming out about REVV Racing, the latest game in the REVV motorsport ecosystem. REVV Racing is set to be the first blockchain-based arcade simulation racing game and gives complete control over the vehicle to the players, in a departure from the current games on offer. It is also being built on Polygon, an Ethereum scaling solution, intended to make the user experience far more pleasant and less expensive!

A number of rewards, incentives, and updates were announced or rolled out during July relating to REVV Racing. This included exclusive racing car NFT drops to wallets holding enough REVV tokens, a date for the public alpha launch, and was capped off with a token staking deployment on Superfarm. Studying the price chart, it's easy to see the effect of the first NFT drop, with the snapshot date for holding REVV being 16th July. Since then, the price has risen steadily as the liquidity/staking farms came online, offering NFT based incentives for participants and driving demand for REVV tokens.

Aside from the staking and liquidity farms taking REVV off the market, the very end of the month saw the introduction of a Pancake Swap liquidity pool on the Binance Smart Chain. Incentivised with REVV tokens and currently returning 160% APR, this pool is just another liquidity sink for the token. If this affects mainnet liquidity levels, you can expect REVV's allocation in MVI to decrease in accordance with the liquidity weighted portion of the methodology.

In terms of detractors from performance, RFOX and MEME specifically have been disappointing. We have removed the RFOX token from MVI during this month's rebalance due to concerns around the token's liquidity on DEXs. As for MEME, the token is still down 87% from its ATH hit on March 24th. It's hard to attribute this performance to anything in particular, other than perhaps lack of new features and poor token economics.

Shortly after the inception of MVI, MEME announced its long-anticipated v2 of the platform. The team said they were working on additional utility for pineapple points, innovative & advanced tokenomics, etc. Then there was Nifty's, a new NFT platform launched by some of the MEME's founders, which was expected to "leverage the MEME token going forward." So far, however, there have been no new developments on the tokenomics front, and token utility continues to be limited. We do see a path forward where MEME functions as more of a traditional NFT marketplace, but, at this point, it's a bit of a wait-and-see situation for the token.

Closing Thoughts

As we tend to, we wanted to highlight several other research pieces that we published in July. In the most recent article, we did a bit of a Metaverse 101, providing an overview of the Metaverse and MVI. And earlier in the month, we published a high-level piece on the Metaverse and the future of work. For those of you looking for audio content, we recorded a podcast episode with Mason Nystrom from Messari, covering the Metaverse, the macro narrative behind this theme, and some of our favorite tokens in the space.

Last week, we successfully rebalanced MVI in line with the methodology. We have added two new tokens to the index, ILV and ERN, and removed RFOX due to poor liquidity. For further details on the rebalance, check out "Expanding the Metaverse - New additions to MVI."

The REVV game with car ownership seems simple yet fantastic. I reckon owning a car as youngster, modifying it etc would have been epic. Then being able to deploy it in network games or on a friends system. Sounds cool. Odd though that they are building the game on Polygon but mining on Binance Smart Chain. Or did I miss something?